Airwallex Raises $300M at $6.2B Valuation to Expand Global Banking Services

Weekly Funding news up to Friday, 23rd of May 2025.

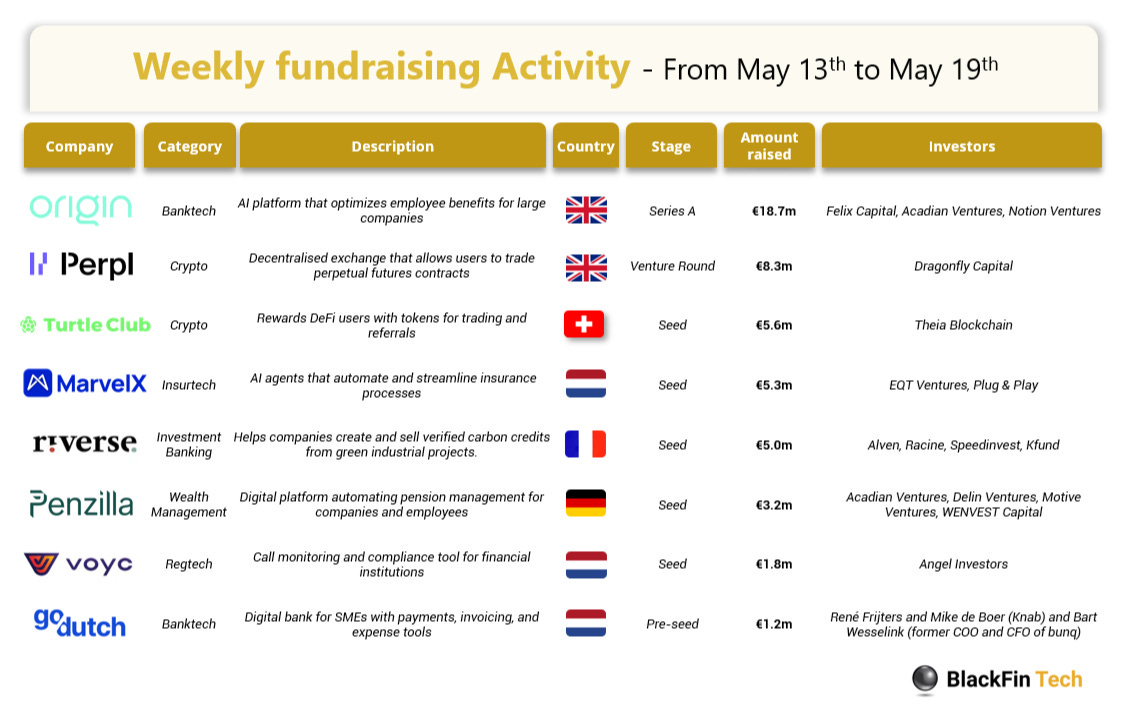

WEEKLY FUNDRAISING ACTIVITY

👀 NEWS HIGHLIGHT

Airwallex, a leading global payments and financial platform for modern businesses, has completed a $300 million Series F funding round at a $6.2 billion valuation. The round includes $150 million in secondary share transfers.

The new investment, which brings Airwallex’s total funding to more than $1.2 billion, includes Square Peg, DST Global, Lone Pine Capital, Blackbird, Airtree, Salesforce Ventures, and several leading pension funds in Australia.

Visa Ventures also joins as a strategic investor. Airwallex will use the additional capital to expand its global infrastructure into new markets and continue refining and scaling the software that empowers businesses to operate anywhere, anytime.

🤝 M&As

Singapore’s GIC seeks CCI approval to acquire 2.14% stake in Groww. Groww has been planning to raise around $200 million in its pre-IPO round. The deal could value the Bengaluru-based stockbroking platform at $6.5- 7 billion. Read more

Groww to acquire wealthtech startup Fisdom. The deal, which values Fisdom at about $150 Mn, is subject to regulatory approval. With the acquisition, Groww is looking to expand its offerings in the wealth management space.

Betterment acquires Rowboat Advisors to accelerate the platform for RIAs. The acquisition strengthens Betterment's technology platform and accelerates its roadmap for delivering sophisticated tools to RIAs through Betterment Advisor Solutions.

Republic is in talks to acquire Indiegogo in an all-stock deal. This move aims to expand the Republic’s private market capabilities and revive the crowdfunding pioneer’s global reach. Continue reading

Etops acquires financial planning software provider Finanzportal24. The wealthtech, which specialises in wealth and asset management technology, says the acquisition of Finanzportal24 will enable the company to provide financial services firms with an "even broader range of integrated client advisory solutions".

Finastra to sell Treasury and Capital Markets business to Apax Partners. The CEO of Finastra stated that the sale marks a significant milestone as it prepares to enter its next phase with a focused suite of mission-critical financial services software. He noted that the transaction will provide capital to accelerate Finastra’s strategic initiatives and enable reinvestment in its core business.

EFG Finance approves acquisition of Fatura by MaxAB-Wasoko. With Fatura fully integrated into the MaxAB-Wasoko platform, retailers will immediately benefit from a broader, more comprehensive product assortment, critical in a fragmented supply chain environment where no single distributor can meet all retailer needs.

Private equity circles Green Dot as bank-backed FinTech seeks buyer amid regulatory hurdles. The US FinTech, known for its prepaid debit cards and banking infrastructure, is attracting strong interest from private equity firms as it explores a potential sale.

Apex acquires majority stake in tokenisation firm Tokeny. According to Apex, the deal shows the fund services firm's commitment to pushing the institutional adoption of tokenisation as well as bolstering its own digital assets infrastructure.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🎉 NOTABLE FUNDING ROUNDS

⭐️ Greenlite AI Raises $15 Million Series A.

⭐️ Sam Altman’s World Raises $135M in Token Sale to a16z and Bain Capital Crypto.

⭐️ Ringkas raises US$5.1 mil pre-series A round.

⭐️ Global FinTech CrediLinq raises $8.5m series A.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

UK-based Ontik raises €3.2M to help wholesalers replace spreadsheets with automated payment tools. The company looks to replace these manual processes with digital tools, beginning with industries where extended payment terms are standard.

EUROPE 🇪🇺

Vivriti Asset Management raises $20 Mn from the Development Bank of Austria. The platform focuses on investing in asset-backed securities that are backed by granular retail and MSME loans, thereby supporting NBFCs and other financial institutions serving underserved borrower segments.

Auric secures €4m seed round to accelerate growth and revolutionize embedded finance. This latest investment represents a strong vote of confidence in Auric’s vision and marks a significant step forward as the company accelerates its efforts to redefine embedded financial solutions.

Wealthreader raises €1 million to strengthen its dominance in Open Banking. This funding represents a significant milestone in its expansion and strengthens its position in the competitive global Open Banking market, a sector experiencing annual growth of over 27%.

German FinTech startup Aufinity Group raises €23 million to innovate payments in the automotive sector. With this funding round, the group is setting its sights on accelerating growth across Europe. By forming new strategic partnerships with leading OEMs and maintaining a strong focus on dealerships.

USA 🇺🇸

Circle denies report it’s considering a potential sale. A media report stated that it was in informal talks about a potential sale to Coinbase Global or Ripple while still pursuing the initial public offering. The Circle spokesperson said, “Circle is not for sale. Our long-term goals remain the same.”

True Markets raises $11 million and launches new Solana-focused crypto trading app. It is launching a trading app this week targeted at retail customers, which will allow users to buy and sell tokens based on the popular Solana blockchain, and soon other top cryptocurrencies such as Bitcoin and Ethereum.

Seeds secures $10M Series A funding round to reimagine personalized investment management. This latest round allows the firm to accelerate product advancements, support strategic growth with high-impact hires, and solidify its market position as an investment experience platform for registered investment advisors.

Blooms raises $2.6m in seed funding. The company intends to use the funds to expand operations and its development efforts. Led by Francisco Meré, Blooms focuses on AI-driven trade finance, payments, and FX solutions for Latin American produce exporters supplying the US and Canadian markets.

US FinTech startup Affiniti raises $17m in series A. The Series A funding will support the expansion of the platform’s offerings, including banking, bill payments, cash flow analytics, and integrations with enterprise resource planning and point-of-sale systems.

Lendflow secures $15 million in growth capital. This growth capital is specifically allocated to accelerate key product initiatives, with a particular focus on powering the next generation of its AI-driven data intelligence and automation platform.

Clair has raised $23.2 million in Series B funding. This funding allows Clair to further its mission to solve the everyday cash flow challenges faced by so many. In the last 2 years, the company has massively accelerated, now enabling over 2M employees to access their earned wages, often in under 75 seconds for new users.

CANADA 🇨🇦

Keep raises C$108m to transform small business banking in Canada. This investment will accelerate Keep's mission to solve critical cash flow and operational challenges faced by Canada’s 3 million small businesses. Continue reading

ASIA

Thndr unveils new products and USD 15.7m at Egypt’s first FinTech Keynote. Thndr is officially seeking an asset management license in Egypt. That move would allow it to design and run its financial products with no middlemen or repackaged imports.

Bithumb claims larger slice of Korea’s crypto space ahead of IPO. Bithumb’s resurgence comes as it prepares for an initial public offering expected to take place by the end of 2025. The company has prioritized wrestling trading activity away from Upbit through aggressive marketing tactics.

PaySprint to raise $3 mn to expand financial API solutions for businesses. It will utilise the freshly raised capital in boosting its product portfolio, expanding AI capabilities, and talent acquisition. Continue reading

AUSTRALIA 🇦🇺

Securely Group launches USD 6 million Series A funding. The funding round is led by RSB Capital, and the money is to be used for accelerating global growth, expanding commercial licensing opportunities, and investment in new technologies.