Bilt has Raised $250 Million in New Primary Funding

Weekly Funding news up to Friday, 11th of June 2025.

WEEKLY FUNDRAISING ACTIVITY

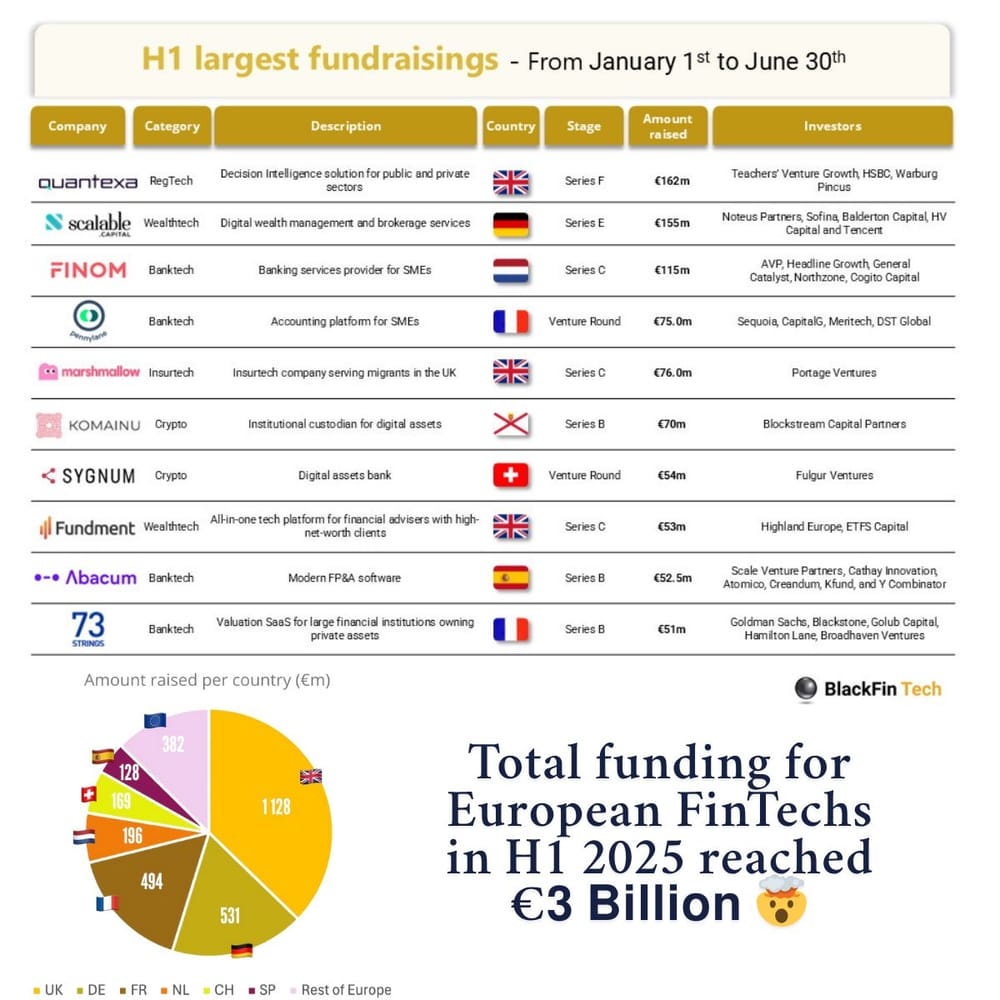

Total funding for European FinTechs in H1 2025 reached €3 Billion.

Let’s connect the dots... and break down the stats:

👀 NEWS HIGHLIGHT

Self-clearing brokerage infrastructure platform Alpaca has agreed to acquire London-based WealthKernel, as it plans to aggressively expand into Europe, executives tell Axios exclusively.

Why it matters: Alpaca believe Europe is critical for growth, as Revolut, Monzo, and N26 pursue rapid international expansion.

Zoom in: The deal immediately provides Alpaca brokerage licenses in the U.K. and the EU, allowing it to bypass a lengthy regulatory licensing process.

🤝 M&As

Flow has been acquired by Snelstart. The two companies had previously collaborated on integrating Adyen’s payment infrastructure into Snelstart’s accounting platform. The acquisition is described as a strategic move, with both companies aiming to benefit from each other’s networks. Flow will continue to operate under its name as part of the Snelstart Group.

Clarity AI buys sustainability FinTech ecolytiq. The deal expands Clarity AI's climate engagement offering for global retail and commercial banking financial institutions. Ecolytiq’s platform specialises in analysing real-time transaction data to quantify environmental footprints and deliver high-impact sustainability content.

Alpaca buys WealthKernel in European brokerage push. The deal immediately provides Alpaca brokerage licenses in the U.K. and the EU, allowing it to bypass a lengthy regulatory licensing process. Continue reading

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🎉 NOTABLE FUNDING ROUNDS

⭐️ Bilt has raised $250 million in new primary funding.

⭐️ Stablecoin startup Agora raises $50 million Series A led by crypto VC giant Paradigm

⭐️ Former Citadel Quants Raise $36 Million for Fixed-Income FinTech.

⭐️ Nominal lands $20M to automate enterprise finance.

🌎 REGIONAL HIGHLIGHTS

EUROPE 🇪🇺

Irish FinTech Nomupay lands $40M at a $290M valuation from SoftBank. The startup will use the new capital for the next phase, which involves expanding its reach in key regions as well as acquisitions. In addition, it will double down on scaling its sales and operations to reach existing and new locations.

Dutch AI FinTech Conpend secures majority investment from Cape Investment Partners. This strategic investment will significantly accelerate Conpend's growth ambitions, supporting its global expansion, enhancing product innovation, and broadening its customer base among banks and financial institutions worldwide.

USA 🇺🇸

FinTech Netcapital bags $9.9M direct offering round. The funds raised in this round will be used by Netcapital to repay certain outstanding promissory notes and for general working capital. Continue reading

Monzo alumni Gradient Labs raise $13M for AI customer service agents for financial services. The company plans to use the funding to finance a US expansion and to court customers. It is looking to hire a sales and marketing person stateside and plans to double its currently 20-strong team by the end of the year.

Castellum.AI raises $8.5M. The firm claims to reduce AML/KYC false positives by 94% and the time spent on compliance reviews by 83% out of the box, before any tuning. Its AI agents have been trained by ex-regulators, ensuring that they passed CAMS practice exams first try.

ASIA

Saudi FinTech Tarmeez secures funding led by stc’s Tali. The funding will enable Tarmeez Capital to scale its platform, expand its offerings, and deliver advanced financial solutions across the Saudi market. Read more

UAE mortgage FinTech Huspy takes in $59M ahead of Saudi entry. Huspy will be adding a new market, Saudi Arabia, this year. To support its expansion, the company is hiring for expansion and technology-specific roles. Continue reading

NRI-focused FinTech startup Belong raises $5 million in round led by Elevation Capital. The fresh money will be used to acquire regulatory licences, build the product suite, and invest in marketing and geographic expansion. Read more

Bazaar acquires Keenu to create ‘integrated commerce-FinTech platform’. According to a statement, “this marks the first time a major Pakistani e-commerce company is bringing payments infrastructure in-house, a strategic move with transformative potential for millions of consumers and businesses across the country.”