Steve McLaughlin's Deal Machine FT Partners to Lead $2-4bn Transaction with Banking Circle

Weekly Funding news up to Friday, 6th of December 2024.

Hey FinTech Fanatic!

FT Partners, the powerhouse dealmaker in FinTech led by Steve McLaughlin, is set to take charge of a major transaction involving Banking Circle, valued at $2-4 billion and backed by EQT. Known for driving marquee deals, including capital raises for Revolut ($33 billion), Monzo, Mollie, Mambu, and PPRO, FT Partners is taking on yet another high-profile assignment.

According to Bloomberg, a sales process for the Luxembourg-based Banking Circle is expected to begin in Q1 2025. The deal could attract interest from private equity firms, credit card giants, and major banking players. EQT acquired Banking Circle in 2018 from Saxo Bank A/S, and recent reports from Reuters indicate that Morgan Stanley is already involved in working with EQT on the potential sale.

FT Partners' exclusive focus on FinTech transactions and its unmatched track record position are perfect for steering this significant deal. Stay tuned for updates on what's shaping up to be one of the biggest FinTech transactions of 2025.

Cheers,

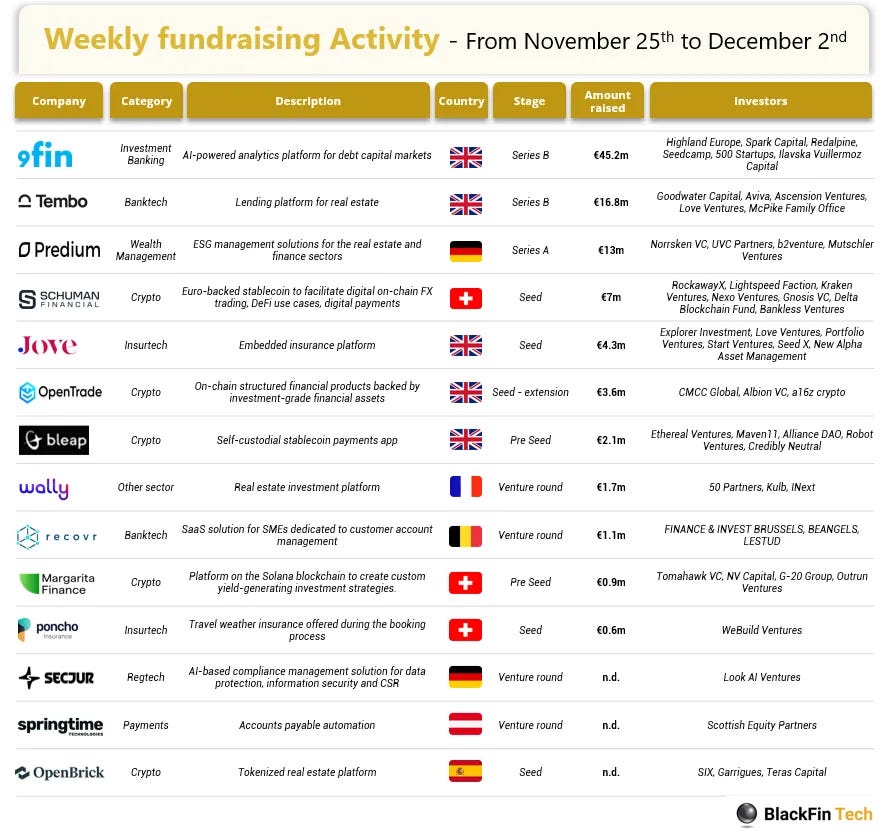

WEEKLY FUNDRAISING ACTIVITY

👀 NEWS HIGHLIGHT

British payments firm Sokin has announced its acquisition of Norwegian FinTech Settle Group AS for an undisclosed sum.

The move positions Sokin to bolster its technological capabilities and enhance its offering, including its flagship product, Sokin Pay. This strategic acquisition directly plays into Sokin’s growth trajectory, aligning with its vision to transform international payments.

📰 ARTICLE OF THE WEEK

🤝 M&As

BlackRock is near deal to buy private credit manager HPS. The purchase would vault the firm into the top ranks of private credit as it seeks to become a major force in alternative assets. The deal would leave BlackRock, which manages $11.5 trillion, with more than $500 billion of alternative assets.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🎉 NOTABLE FUNDING ROUNDS

⭐️ Revolut crowdfunders in line for 400 times return on investment.

⭐️ Amsterdam’s ThreatFabric raises additional funds from Rabo Investments to enhance banking security.

⭐️ Brighty raises $10M for crypto-integrated digital banking platform.

⭐️ Lumin Digital Secures $160 Million in Growth Funding.

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

Revolut will let former staff sell stock in secondary sale. The company has informed former staff that those who had been with Revolut for at least 24 months and held $100,000 or more in vested shares can sell up to 5% of their portfolio, according to a memo seen by Bloomberg News. Meanwhile, early investors, including those through Republic Europe, are being offered an opportunity to cash out in this initiative, which has reportedly helped avoid potential legal challenges, as revealed by City AM.

Tembo raises EUR 16.8 million to support first-time property buyers. The funds will help Tembo expand its solutions, scale its savings app, and introduce new mortgage schemes to tackle affordability challenges in the UK housing market. The investment brings the company’s total funding to EUR 24 million.

London-based 9fin raises €47.5 million to advance AI-powered debt capital markets platform. The funding will support 9fin’s ongoing development of its AI technology, expansion into the US market, and growth of its analytics team. Find out more

London’s Synthera raises €1.7M to transform financial market analysis with GenAI. The company will use the funds to accelerate product development, expand its team of engineers and data scientists, and collaborate with financial institutions to pilot its technology.

EUROPE 🇪🇺

Klarna founder-backed Predium cements €13M to decarbonise real estate with AI. The fresh capital will enable Predium to strengthen its position as a prominent real estate intelligence platform for sustainable and economic management while exploring new markets.

ASIA

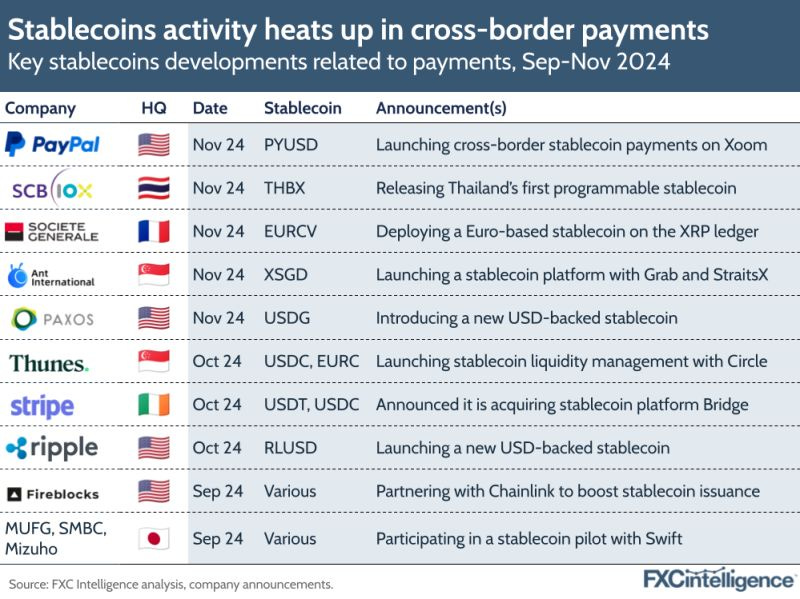

Tenity to invest in XRP Ledger startups as it doubles down on DeFi. The company is expanding its focus on decentralized finance (DeFi) through Incubation Fund II, supporting startups building on the XRP Ledger (XRPL) across Asia and Europe.

KPay, a financial management platform for SMEs, raises $55M Series A. The funds will support product development, accelerate go-to-market efforts, enhance customer experience, expand into new Asian markets, and pursue growth through mergers and acquisitions, according to the company’s CFO.

AFRICA

HUB2 banks $8.5M to become the ‘Stripe for Francophone Africa.’ HUB2 already works with some 55 neobanks, payment companies, remittance companies and cryptocurrency providers, and it has now picked up $8.5 million to expand that list, and to up its game in its tech stack.