Despite comprising less than 1% of the $150 trillion+ B2B payments market, the commercial card space represents a huge opportunity for fintechs.

In 2021 alone, they raised over $2.3 billion in venture capital funding and have shown no signs of slowing in 2022 with $1.8 billion raised in the first four months of the year (Figure 1).

👉 Read the full Mouro Capital article here

👀 NEWS HIGHLIGHT

Despite the stalled IPO market, here are 19 FinTech and crypto startups that may still go public this year — and the investors who will benefit.

FinTech exits, which include acquisitions and public offerings, grew a staggering 780% last year, PitchBook reported in its 2021 Annual Fintech Report, with a $331.8 billion value from $37.7 billion in 2020.

👉 Read the full list here.

📊 INFOGRAPHIC

FT Partners Research released their Q1 2022 FinTech Insights report.

👉 Read the full article here.

📰 ARTICLE

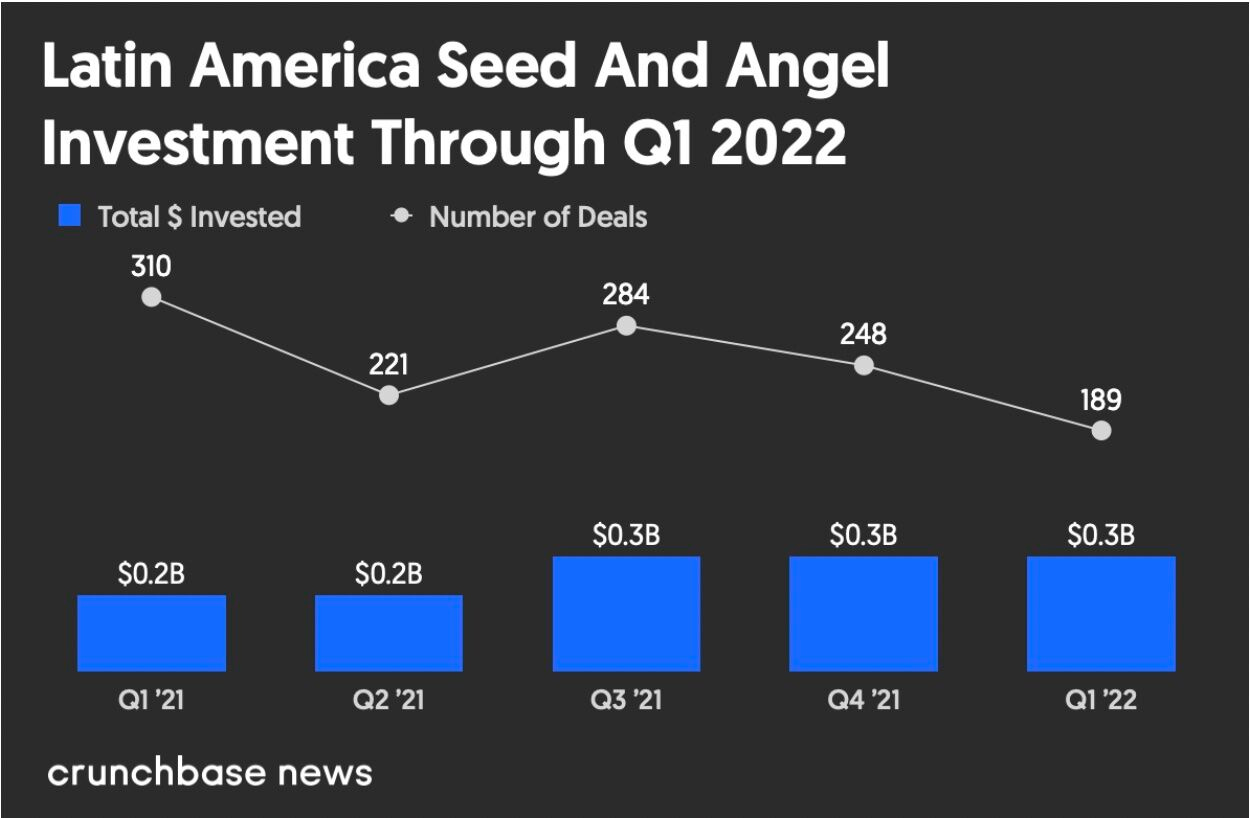

While the unicorn scene in LATAM has cooled some this year, funding at the very earliest stages remains quite robust.

👉 Read the full Crunchbase article by Joanna Glasner here.

👨💻 BLOG

With Kard, banks and fintechs can build custom credit card rewards programs.

Kard‘s rewards-as-a-service API streamlines the process for card issuers, allowing them to create a customized rewards program tailored to their particular customer base by choosing from Kard’s set of merchant partnerships.

👉 Read the full article here.

💬 INTERVIEW

Onevest secures $5 million to help companies like neo financial launch wealth management products. “What Stripe has done for payments, we’re doing for wealth.”

👉 Read the full article here.

💡INSIGHTS

Angel investors injected over $6.9bn into European FinTechs last year, with two angels participating in each seed round on average, according to Dealroom.co.

👉 Read the full article, with the full list, by Amy O'Brien here.

🎤 PODCAST

The podcast recommendation of the week belongs to the Equity series by TechCrunch with hosts Alex Wilhelm, Natasha Mascarenhas, Mary Ann Azevedo as they discuss the numbers and nuance behind the headlines this week.

👉Listen to episode 506 here.

💰 VC FUNDS

Crypto-focused Dragonfly Capital launches $650M third fund. Link here.

AngelList closed an additional $44M from their GP and LP community at a $4B pre-money valuation. Link here.

The Board of Directors of the African Development Bank has approved an equity investment of €9.8 million to support venture capital investments in African start-ups. Link here.

Startupbootcamp (SBC) is launching the Sustainable Fintech Fund to invest in the top emerging sustainable fintech startups from around the world. Link here.

🤝 M&As

Ant Group announced the acquisition of payments platform 2C2P its cross-border payments network across Asia. Link here.

Nium announced a definitive agreement to acquire Socash, a Singapore-based alternative payments network platform. Link here.

Starling Bank bags £130.5m from existing investors to build a "war chest" for acquisitions. Link here.

Banking Circle Group announced that it has acquired Account-to-Account (A2A) payment provider SEPAexpress to expand its financial ecosystem. Link here.

🛳 PARTNERSHIPS

Plug and Play launched in the UK. Through partnerships with leading UK brands – including founding partners Jaguar Land Rover and BT Group – Plug and Play. Link here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🎉 NOTABLE FUNDING ROUNDS

⭐️ Outfund scores £115 million to loan over £500 million to e-commerce firms this year. Link here. Outfund also has announced the close of a $20m Series A round, led by existing investor Force Over Mass, and joined by three new investors. Link here.

⭐️ Airwallex, a payment platform startup, is looking to raise as much as $150 million in an extension of its series E funding round, according to people familiar with the matter. Link here.

⭐️ Payd announced that it has raised US$1.7 million (RM7.5 million) in a seed funding round led by IFS Capital. Link here.

UK 🇬🇧

Atlantic Money founded by Patrick Kavanagh and Neeraj Baid in 2020, has attracted a wealth of top-tier investors, including Coinbase-backer Ribbit, Kleiner Perkins, 20VC founder Harry Stebbings, and the creators of Robinhood, Vladimir Tenev and Baiju Bhatt. Link here.

Monspire has raised £600K funding in a round led by Fuel Ventures. Link here.

Tencent has led a funding round into London-based fintech Previse. Link here.

Volume raised $2.4M in funding. The round was led by first-minute Capital with participation from SeedX, Haatch Ventures and more. Link here.

Argent, a U.K. startup, pledges to bring the concept of super-apps to cryptocurrencies. They raised $40 million led by Fabric Ventures, Metaplanet. Link here.

ModusBox secures $7.5 million in series funding to accelerate innovation for community financial institutions. Link here.

Airwallex is looking to raise as much as $150 million in an extension of its series E funding round. Link here.

Unbanx raises $1m to help people earn ‘passive income’ from their data. Link here.

USA 🇺🇸

Copper Banking has raised $29 million in Series A funding in a “preemptive” round led by Fiat Ventures. Link here.

Ex-Chime engineers raise $4M for B2B payments infrastructure startup Streamlined. Link here.

Ellis raises $5.6M to pave the way for international students. Before they arrive, they can open a debit account with Ellis’ neobank and sign up for a 5G cellphone plan, too. Link here.

Rain has raised $6 million in seed funding to provide corporate credit cards for decentralized autonomous organizations (DAOs). Link here.

LATAM

Ribon snags a $3.5 million post-Seed round and prepares to become a DAO startup. Link here.

AUSTRALIA 🇦🇺

Stake has raised an additional $50 million as it caters to the next generation of Australian retail investors. Link here.

ASIA

Fi is in the advanced stages of talks to raise about $100 million at a $700 million valuation, according to three sources familiar with the matter. Link here.

Coda Payments raised $690m in funding. The company intends to use the funds for international expansion. Link here.

Koshex has raised US$2.1 million in a seed round led by Y Combinator, the former told Tech in Asia. Link here.

Kinara Capital closed a fresh equity round of USD $50 million led by Nuveen, a leading global investment manager with over $1.3 trillion of assets under management, with participation from Triple Jump. Link here.

MIDDLE EAST

Zenda is eyeing Africa as its next frontier for growth, accelerated by the $9.4 million seed funding it has raised. Link here.

OPPORTUNITIES

Mozper is looking to hire for the following positions:

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.