REPORT

Financial Technology Partners / FT Partners’ Monthly FinTech Deal Activity Insights.

👉Link to the Financial Technology Partners / FT Partners’ Monthly FinTech Deal Activity Insights and download the full report here.

👀 NEWS HIGHLIGHT

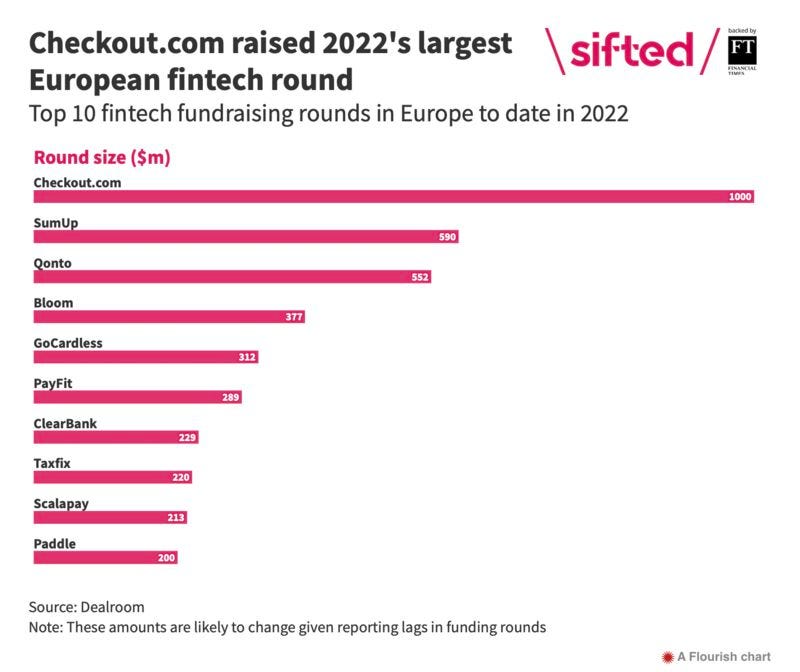

FinTech deals have officially retreated to pre-2021 levels.

So far this year, Dealroom figures show that European FinTechs have raised $13.2bn — still a solid overall sum, but the lowest six-month total since 2020.

The picture is even bleaker just looking at the second quarter, when companies raised $5.5bn, the weakest quarter since the beginning of 2021.

👉Read the full Sifted article by Amy O'Brien here.

😎 SPONSORED CONTENT

2022 is set to be a pivotal year in the adoption and regulation of cryptocurrencies. So as regulators, policymakers and the media pay more attention to the financial crime risks associated with crypto, what can compliance teams do to ensure their AML programs are best-in-class? Our new guide addresses this question.

👉 Download your free copy today.

📊 INFOGRAPHIC

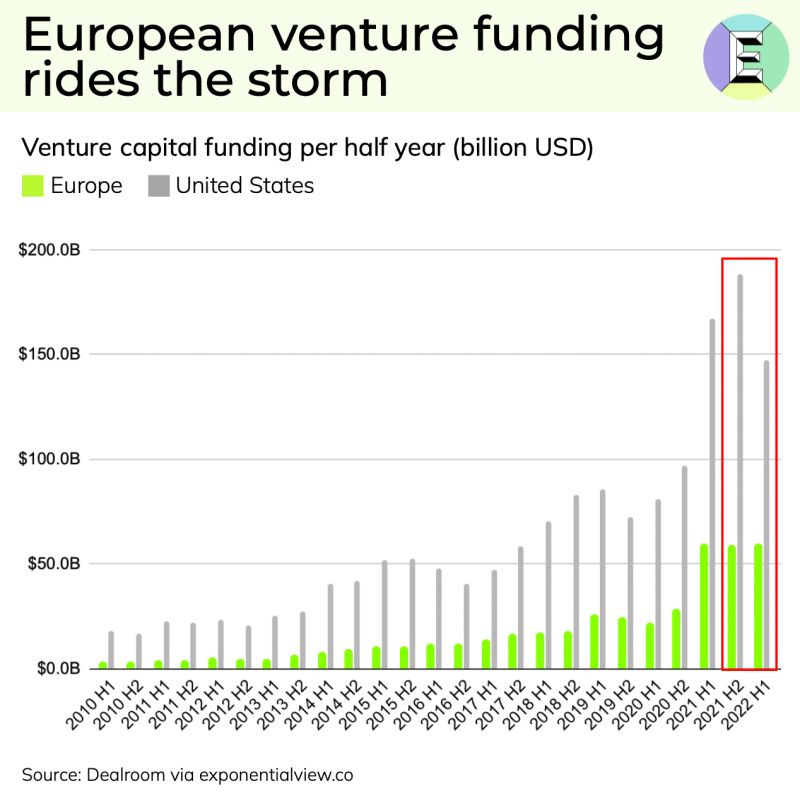

Globally, tech venture capital was reported to have dropped 27% in the second quarter of 2022.

👉Read the full article by Azeem Azhar here.

📊 INFOGRAPHIC

Despite the threat of a downturn in tech stocks and later-stage private valuations, Europe’s seed-stage companies had a strong June. Nevertheless, healthtech replaced fintech as the sector with most investments at the seed stage.

That trend was reflected in the three biggest rounds of the month: all were healthtech companies.

👉Read the full Sifted article by Freya Pratty here.

📰 ARTICLE

VC investment in Latin America ballooned in 2021. Can it survive the downturn?

In 2021, venture capitalists invested $14.8 billion into startups in Latin America.

The nearly $15 billion was more than the previous six years of venture investment combined, according to PitchBook.

👉Read the full Protocol article by Biz Carson here.

💰 VC FUNDS

Lightspeed Ventures Partners has announced it has secured a cumulative $7.1 billion to bankroll 4 new crypto funds. Link here.

BlackFin Capital Partners announced the second closing of its Tech 2 fund at €350M.

With the new fund, the firm doubles down on its strategy to back and develop promising B2B fintechs and insurtechs across Europe. Link here.

🤝 M&As

GoHenry expanded into Europe for the first time with the acquisition of French startup Pixpay. Link here.

Buckaroo acquires a majority stake in point-of-sale payment service provider SEPAY BV with the support of Keensight Capital. Link here.

M2P Fintech, an Asian financial Infrastructure company recently announced it has acquired Finflux, a cloud lending platform. Link here.

DOKU announced that it has acquired Malaysian online payment gateway senangPay for US$7.5 million by raising the funds needed from Apis Growth Fund II. Link here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🎉 NOTABLE FUNDING ROUNDS

⭐️ Wefox has raised $400 million in a series D round of funding, giving the German company a post-money valuation of $4.5 billion. This represents a 50% increase on last year’s $3 billion valuation at its series C round. Link here.

⭐️ Klarna announced the closing of a new $800m financing at a $6.7bn post valuation. The financing attracted strong support from both existing and new investors and will primarily be used to expand Klarna's leading market position in the United States. Link here.

⭐️ Zip Co and Sezzle have mutually agreed to cancel an agreed upon merger, following a horror few months that has seen the financial prospects of both companies severely damaged. Link here.

UK 🇬🇧

The London Stock Exchange Group launched a new Review into FinTech Funding, with industry group FinTech London. The Review will look to bring together regulators, investors, and finance firms to address the rapid deterioration of the venture capital landscape for fintech. Link here.

EUROPE 🇪🇺

Oper Credits announced it had secured a €11m series A equity round, led by Bessemer Venture Partners & ABN AMRO Ventures. Link here.

Blossom Capital has led a €29 million investment in Berlin-based Fintech startup Kadmos. Link here.

Hero has raised €12.4mn to scale its B2B payments solution, just seven months after starting out. Link here.

USA 🇺🇸

Quiltt is wrapping its warm low-code fintech infrastructure blanket around startups and small businesses that want to create financial services for their customers, but don’t have the budget resources for a big engineering team. Link here.

Gen Z is getting a dose of some economic medicine that has older generations recalling 2008 and 2001, and Uprise is here for it. With Uprise, they want to provide a tool that arms users with best practices and diversification techniques so they invest with more specific goals in mind. Link here.

Bankers Helping Bankers announced the launch of the Bankers Helping Bankers Fund, a fintech venture capital fund managed by Latitude38 Venture Partners. Link here.

KKR announced the final close of KKR Asset-Based Finance Partners, KKR’s first fund dedicated to asset-based finance investments “ABF.” The approximately $2.1 billion fund will commit capital globally to privately originated. Link here.

LATAM

Kapital (YC W22) obtained 30 million dollars on a Demo Day. The round was led by Tenacity Venture Capital, a Benjamin (BΞN) Narasin's fund. Link here.

DEUNA announced it has raised a total of $37M including a $30M Series A round. Link here.

Chilean insurance-tech startup Betterfly plans to expand overseas after its latest funding round swelled its valuation to $1 billion. Link here.

ASIA

WonderLend Hubs raised USD 1.6 million in a Seed Round led by Inflection Point Ventures. Link here.

Sewa Grih Rin raises $20 million in funding led by Norway-based NMI and Women's World Bank Asset Management. Link here.

Hyperface, a Bengaluru-based modern transaction credit platform, has announced that it has closed a $9 million seed funding round. Link here.

AUSTRALIA 🇦🇺

WeMoney has banked a fresh $7 million, adding Perth billionaire Laurence Escalante and US-based Dream Ventures to its list of investors. Link here.

AFRICA

Zazuu, an Africa-focused fintech that offers customers various remittance options, raises $2M to scale its cross-border payment marketplace. Link here.

MOVERS & SHAKERS

Atomico announced that former Balderton Principal Laura Connell has joined as its latest partner to work on Atomico’s growth-stage investments. Link here.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.