REPORT

The total dollar volume of global FinTech deal activity across private company financings, IPOs, and M&A transactions in Q2 2022 were down 67% from the peak of activity in Q3 2021.

Additionally, Q2 2022 activity declined 29% year-over-year from Q2 2021 and declined 24% from Q1 2022.

👉Download the full Financial Technology Partners / FT Partners report here.

👀 NEWS HIGHLIGHT

What happened for European FinTech in the first semester of this rather chaotic year?

⭐️ 361 FinTechs raised money in H1 2022, equaling a total amount of €11.2bn.

Read the full BlackFin Tech article, with more stats and figures below.👇

😎 SPONSORED CONTENT

Contis helps organisations unleash their true potential with award-winning, cloud-based Banking-as-a-Service solutions. With Contis you can put next-generation cards, accounts and apps in your customer’s hands.

📊 INFOGRAPHIC

Last year, Latin America was the fastest-growing region in the world for venture capital investment. This year, it may be on track to be the fastest-shrinking one.

Venture investment in Latin American startups totaled just $2.3 billion in the second quarter of 2022, per Crunchbase data.

👉Link to the full article here.

👨💻 BLOG

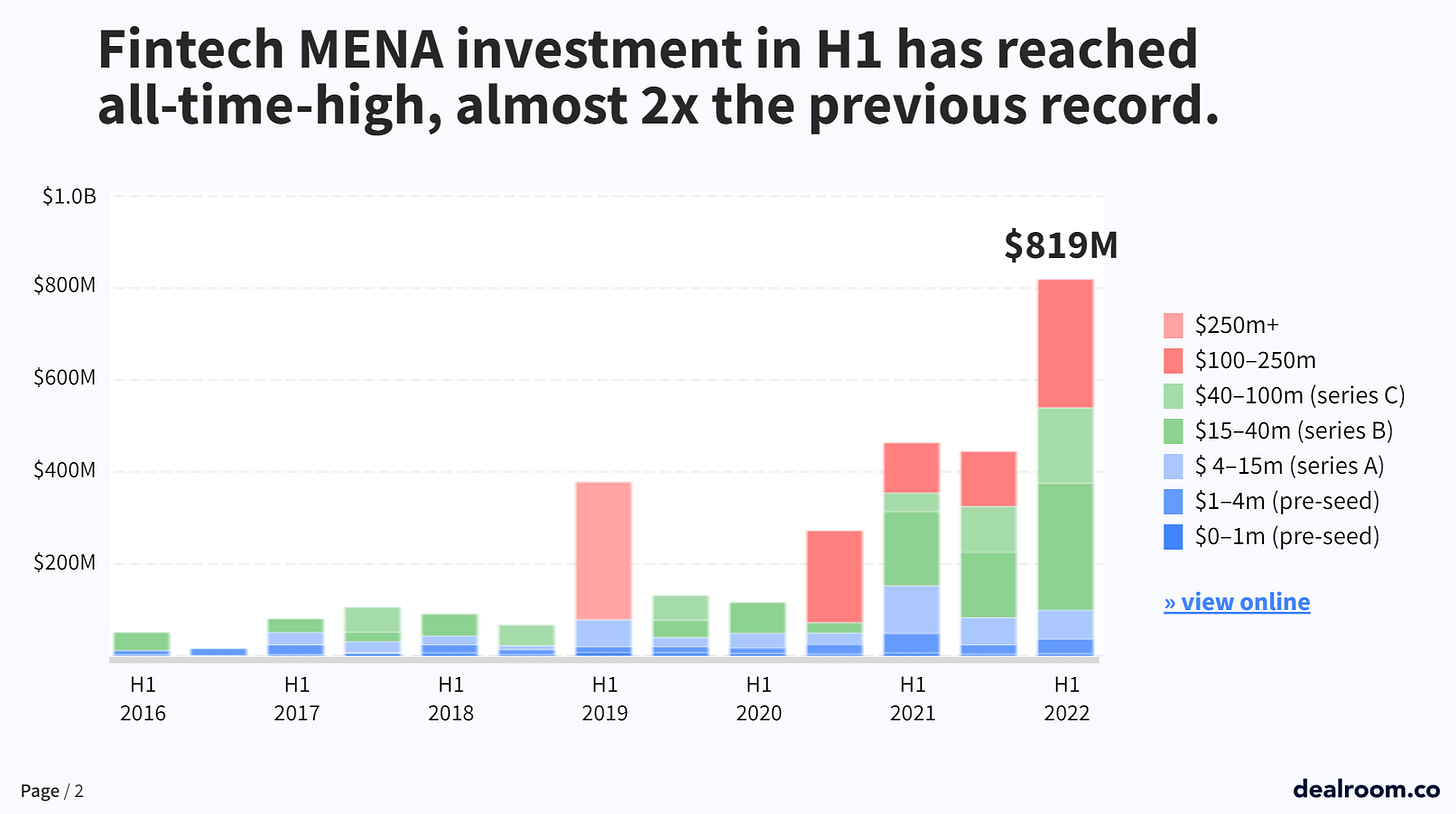

FinTech in the MENA region: a rising star💫

The Middle East and North Africa region opens huge opportunities for FinTechs thanks to the scale of the market and the lack of established financial institutions.

Compared to mature markets, such as the US and Europe, 67% of the adult population are either underbanked or unbanked, 136 million adults.

👉Link to the full Dealroom blog article, with more stats and figures here.

💬 INTERVIEW

TEN13 co-founder Stew Glynn: ‘Great businesses will be built regardless of the market cycle’

Stew Glynn says whilst deals are taking longer to close and unit economics have become a higher priority in later stage funding rounds, he is not seeing any fundamental change in demand at a commercial level for companies within the portfolio - one that he hopes will reach $100 million in funds under management (FUM) over the next year.

👉Link to the full Business news Australia article by Matt Ogg here.

💡INSIGHTS

Last week, €1,344m was raised across 22 FinTech deals.

BNPL Unicorn Klarna raised a €761m Venture round cutting their valuation to $6.7bn from $45.6bn, followed by wefox which raised a €380m Series D with a combination of debt & equity, and finally congratulations to Smart Pension who raised a €46m Growth round.

👉Read the full BlackFin Tech article by Régis Bouyoux here.

🦄 UNICORN CLUB

Stori reaches unicorn status with $50M equity raise. Link here.

The number of new unicorn🦄 births slowed in Q2’22, although the pace was still greater than any quarter prior to 2021. Link here.

💰 VC FUNDS

Jeeves has launched a non-dilutive alternative to venture capital specifically tailored to startups and SMEs. Link here.

Portage Ventures announced that it has closed on $655 million for its third flagship fund, Link here.

Passionfruit has closed a seed round of $3.6m, which brings the total raised by the firm to $4.3m. Link here.

Battery Ventures closes $3.8 billion in new funds, and appoints a new Israeli partner. Link here.

Mendoza Ventures, the first LatinX-owned venture fund on the East Coast announced the appointment of Asya Bradley as Senior Partner. Link here.

🤝 M&As

Penta could be about to be sold to its French competitor Qonto. Link here.

Tifin acquires professional investor community platform SharingAlpha. Link here.

Betterfly has announced its landing in Spain and in the European market after acquiring the Spanish fintech Flexoh, as reported by both companies on their Twitter accounts. Link here.

Advance Intelligence Group announced its acquisition of Jewel Paymentech, a financial risk technology company specializing in merchant due diligence and fraud and risk management solutions for the financial services and payments industry. Link here.

Wizz Financial is preparing to rebrand after getting the approval of the United Kingdom’s Financial Conduct Authority to acquire UAE Exchange U.K. Limited.

FNZ has acquired New Access, a specialized private banking technology firm. Link here.

Flywire has completed the acquisition of Cohort Go, an international education payments provider. Link here.

M2P Fintech, has made its third acquisition this year in identity verification service provider, Syntizen. Link here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🎉 NOTABLE FUNDING ROUNDS

⭐️Atlantic Money secures $3M to launch its money transfer service in the UK. Link here.

⭐️ a16z is moving to the Cloud. Link here.

⭐️ Check out the 15-slide pitch deck Griffin, a banking-as-a-service FinTech, used to raise $15.5 million in fresh funds. Link here.

⭐️Currensea hits crowdfunding target in just two hours, raising £2m. Link here.

UK 🇬🇧

Bloom has raised $6.5 million in a seed funding round. Link here.

EUROPE 🇪🇺

Charles has raised $20 million in Series A funding to help European sellers benefit from e-commerce in WhatsApp. Link here.

USA 🇺🇸

Apiture has closed a $29 million funding round led by Live Oak Bank, with participation from existing investors. Link here.

Pico has secured a $200 million strategic investment from Golden Gate Capital. Link here.

TomoCredit has raised $22 million in Series B funding. Link here.

X1 Card has raised $25 million in a Series B funding round as it gears up for launch in the US. Link here.

Mahalo Banking completed a $20 million funding round. Link here.

Super Mojo, Inc. raised a seed funding round of an undisclosed amount. Link here.

LATAM

Clave launches its application offering personal loans, a prepaid Mastercard, payments, transfers, and an enhanced blockchain portal with a token-based loyalty rewards program. Link here.

Arrenda is offering digital financial services to the real estate market of Latin America and closed on $26.5 million in a pre-seed round of equity and debt. Link here.

FairPlay has raised $10 million in Series A funding. Link here.

LAVCA, the Association for Private Capital Investment in Latin America, has found that startups in Latin America have raised $2.8billion across 190 transactions during Q1 of 2022 as the region’s funding boom continues. Link here.

ASIA

Niyo has raised $30 million from private equity firm Multiples Alternate Asset Management. Link here.

MFast announced it has raised $2.5 million in a funding round. Link here.

AUSTRALIA 🇦🇺

Pearler secures $7.8 million in seed funding led by Portage Ventures. Link here.

Mx51 has raised $32.5 million in a Series B round led by an undisclosed fintech investor. Link here.