REPORT

Venture capital investors scaled back crypto investments in Q2’22 due to macroeconomic pressures and concerns about crypto valuations and stablecoins.

👉Download the full "State of Blockchain Q2’22 Report" by cbinsights here.

👀 NEWS HIGHLIGHT

Unstoppable Finance secured a €12.5 million ($12.8 million) round led by Lightspeed Venture Partners to launch a non-custodial crypto wallet.

Unstoppable's wallet — called Ultimate — aims to draw on the slick user experience seen in fintech apps to attract crypto-curious retail investors. The team behind it thinks a more user-friendly experience, compared with crypto-native offerings such as MetaMask and Phantom, will draw in the masses.

👉 Read the full The Block article here.

😎 SPONSORED CONTENT

At MoneyLion we believe you should get more from your money. Our mission is to rewire the American banking system so that we can positively change the financial path for every hard-working American. Our products offer no hidden fees, and few barriers to entry. Accessibility is what we’re all about. There are no credit checks for cash advances and no hard credit checks for our loan products. Everyone is welcome.

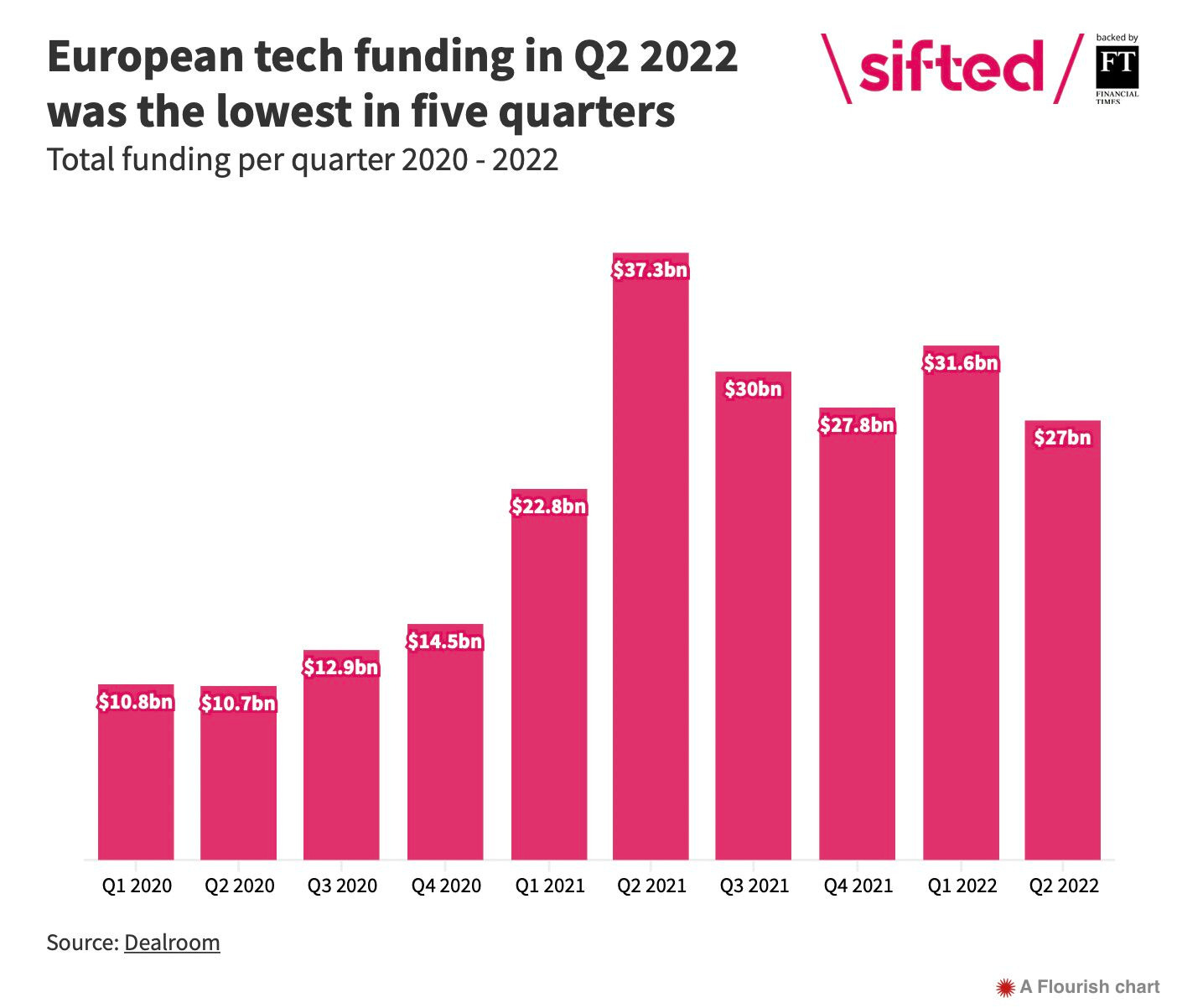

📊 INFOGRAPHIC

Despite a significant amount of capital still being deployed in the first half of 2022 — $59.3bn across 4,000 deals — the days of free-flowing VC cash seem to be over.

👉 Read the full Sifted article by Tom Nugent here.

📰 ARTICLE

Meet 26 rising-star FinTech VCs excited about what's next in the sector — even during a market and investing pullback.

👉 Read the full Business Insider article with the full list of VCs here.

👨💻 BLOG

Personal Updates. Softbank in LatAm. Africa is the last region standing. YC's batch size.

👨💻 BLOG

2021 was a prolific year for neobanks. Several of them raised massive rounds of funding, became unicorns and decacorns, and expanded their global footprints.

👉 Read the full WhiteSight blog by Afshan D. and Samridhi S. here.

🧐 ANALYSIS

News of the funding slowdown, falling valuations, and layoffs dominate tech headlines.

But it’s not all doom and gloom at the earliest stages — new funds are still being raised, and exciting new companies emerge.

👉Read the full Sifted article here.

💰 VC FUNDS

Valley National Bancorp invests $25m in fintech-focused VC The Garage. Link here.

Portal Ventures closes on a $35 million debut fund for early-stage crypto startups. Link here.

🤝 M&As

HRS has acquired German expense management firm Paypense, a move the company said will enhance its suite of corporate payment products. Link here.

Plastiq Inc. has agreed to go public via a merger with Joseph Sambuco’s blank-check firm. Plastiq’s tie-up with Colonnade Acquisition Corp. II will create a company with a value of about $480 million, including debt. Link here.

Avalara is to be acquired by global investment firm Vista Equity Partners in an all-cash deal worth $8.4 billion. Link here.

Legado acquires consumer and B2B bill management technology from WonderBill. Link here.

Jack Henry to acquire Payrailz. Link here.

Sesami Cash Management Technologies announced its acquisition of Planfocus software GmbH. Link here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🎉 NOTABLE FUNDING ROUNDS

⭐️ CreatorDAO raises $20 million in ‘ambitious bet’ on creator economy; a16z and Paris Hilton among backers. Link here.

⭐️ SoftBank Group posted a record loss for the second straight quarter as market turmoil continued to spread across its portfolio of technology stocks. Link here.

⭐️ Investment into female-founded fintechs ‘drops 66%’. Link here.

⭐️ANNA Money founders break ties with sanctioned Russian billionaires. Link here.

UK 🇬🇧

Appital scores £1.7 million investment. Link here.

Lord Hammond enlisted to back £1 billion UK fintech fund. Link here.

Capify launched a £40m fund for UK smaller businesses to help manage operations through difficult trading conditions. Link here.

EUROPE 🇪🇺

Trezy opened its European headquarters in Amsterdam. Link here.

Digital lending platform Auxmoney raises €500m credit line. Link here.

USA 🇺🇸

Food stamp-focused fintech Forage raises $22 million. Link here.

Founderpath secures $145M in debt and equity to help B2B SaaS startup founders avoid dilution. Link here.

Kontempo closes a $30M seed round. Link here.

Payments infrastructure firm Finix raises $30m. Link here.

Lending verification fintech Truework raises $50 million. Link here.

LATAM

NG.CASH raises $10M to provide financial independence to young people in Brazil. Link here.

ASIA

Dezerv has bagged $21 million in a Series A funding round led by Accel Partners. Link here.

Jodo raised $15 million in a Series A round led by Tiger Global. Link here.

Fintech investment in Indonesia is expected to rise in 2022, bucking global fintech investment trends that point to a significant fall in funding this year. Link here.

OCEANIA

SPAC Global Star Acquisition files for an $80 million IPO, targeting fintech and proptech. Link here.