#DoneDeal FinTech | 2022 #39

News Highlight: Frost plans to launch a new fundraising round in autumn.

👀 NEWS HIGHLIGHT

Frost plans to launch a new fundraising round in autumn.

Since its launch in May 2022, the Manchester-based e-wallet provider has raised £1.1M. In fact, the startup closed a seed funding in July with key investors and additions to the team.

As part of the seed round, Andrew Jennings, Managing Director of Osun Capital, joined Frost as Chief Strategy Officer. He will work closely alongside co-founders Pawel Oltuszyk and Edyta Sliwinska to further drive the company’s exciting development plans.

Andrew says, “I invested in Frost for two key reasons: the product, and the founders. From a product perspective, Frost helps customers to save time and money, allowing them to switch household utility providers within the app seamlessly. In addition, as founders, Pawel and Edyta have a proven track record. They have personally funded Frost from concept until launch, which is highly unusual in fintech.”

👉 Read the full Techfunding news article by Vignesh R. here.

😎 SPONSORED CONTENT

Find out how Klarna Kosma’s Bank Transfer helped Kameo, Scandinavia’s leading real estate investment platform, build a faster, more convenient payment option that made it even easier for customers to invest and resulted in 18% crowd growth and a 30% bid size increase.

Click below to grab your copy now!

REPORT

Which neobanks have raised the most capital?

👉 Check out the full report by SEON Fraud Fighters here.

📰 ARTICLE

Top 8 most well-funded FinTech in Africa.

👉 Read the full Fintechnews Africa article here.

💡INSIGHTS

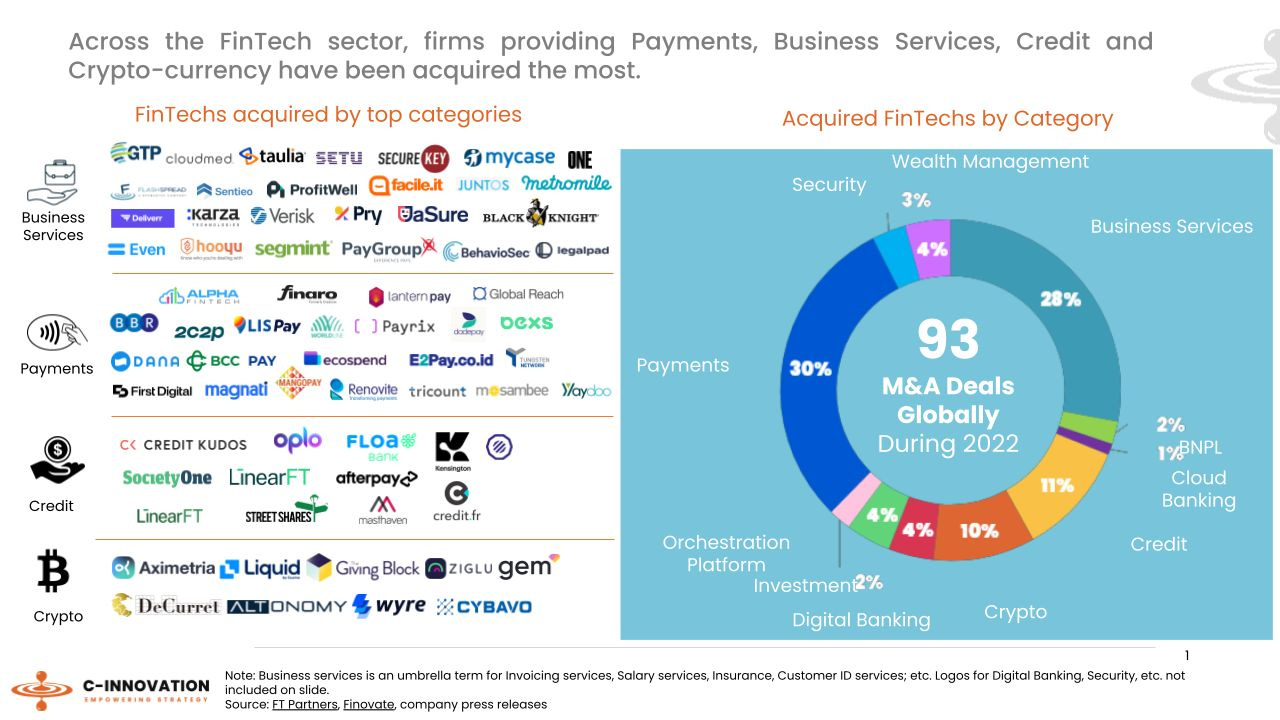

M&A continues to reinvent Banking propositions.

👉 Check out C-Innovation’s Q3 Update on FinTech M&A (Mergers & Acquisitions) here.

🦄 UNICORN CLUB

Satispay has become Italy’s second unicorn created since the dotcom boom, after raising a mammoth €320m Series D.Link here.

Fasanara Capital launches $350m fintech and crypto VC fund. Link here.

💰 VC FUNDS

Point Nine raised a new seed fund of €180m. Link here.

Aviva invested $10 million in a VC fund that backs female entrepreneurs in the fintech industry across the UK, Europe, Canada, and the US. Link here.

🤝 M&As

Billtrust has been sold to the investment organization EQT in an all-cash transaction that values Billtrust’s equity at approximately $1.7 billion. Link here.

Coinsquare is set to buy rival CoinSmart Financial in a deal worth around C$29 million in cash and shares. Link here.

Aquila enters the Latin American fintech ecosystem through the platform acquisition of Neosoft. Link here.

The PNC Financial Services Group, Inc. acquired Linga. Link here.

Public is in talks to acquire Dutch trading startup BUX. Link here.

Worldline to acquire a 40% stake in Online Payment Platform B.V. Link here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🎉 NOTABLE FUNDING ROUNDS

⭐️ Shaype defied the tech world’s capital raising drought, ruling off a $33 million round and scoring a top-up from Regal Investment Partners. Link here.

⭐️ Former Revolut employees launch Solvo, an app that simplifies crypto investing. Link here.

⭐️Toqio secures €20 million to be the platform of choice for building new fintech solutions. Link here.

⭐️ Binocs raised $4 million to expand in markets like the United States, United Kingdom, and Australia. Link here.

UK 🇬🇧

Perenna raises $30m from Zopa-backer IAG Silverstripe. Link here.

Liberis secured an additional £140 million in financing from Barclays and BCI Finance. Link here.

Currensea bags £2.4m for open banking travel card launched with the “worst timing in history”. Link here.

EUROPE 🇪🇺

myTU closes €5 million seed round. Link here.

Memento raises a $1.2M funding round. Link here.

SeQura receives up to €150M of financing from Citi. Link here.

Telefónica targets fintech with new vehicle Íope Ventures. Link here.

USA 🇺🇸

AccessFintech raises $60M to unlock trading data for banks. Link here.

Cheq raises $8M in seed funding. Link here.

CNote raises $7.25M in series A funding. Link here.

Funding Circle struck a new lending deal worth £700m with Bayview Asset Management. Link here.

Strike raises $80M, aims for Visa. Link here.

Goldman Sachs recorded several global deals that have contributed to making its investments bag full. Link here.

LATAM

Wolet raises USD 2M to facilitate credit to SME's in Latin America. Link here.

The trend in LatAm is not lost among venture capital firms. Investments in this sector jumped from $68 million in 2020 to $658 million in 2021. Link here.

CARIBBEAN

FTX is in talks to raise $1 billion at a valuation of about $32 billion, in line with the prior round. Link here.

ASIA

Signzy raised Rs 210 crore (about $26 million). Link here.

Instapay Technologies raised US$4.75 million (RM 21.5 million)the in Series A funding round. Link here.

KPay completes US$10 million financing. Link here.

AUSTRALIA 🇦🇺

Adatree successfully closes second raise, with strong backing from B2B SaaS founders and exited founders. Link here.

National Australia Bank takes on accountants by backing Xero rival. Link here.

MIDDLE EAST

Noble has emerged out of stealth with $18 million in a funding round led by Insight Partners. Link here.

AFRICA

Numida raised $12.3 million in debt and equity funding. Link here.