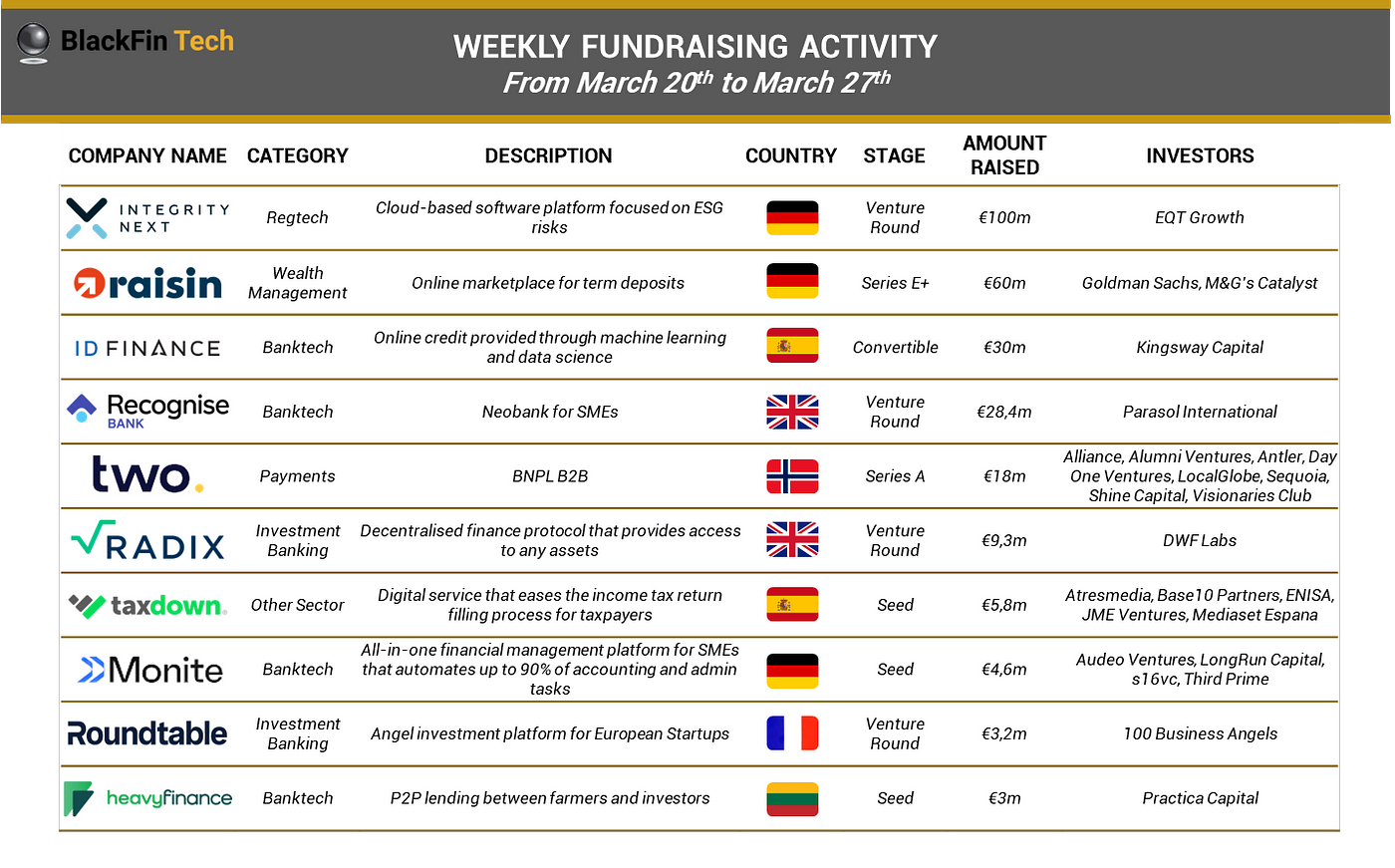

Last week, we saw 18 FinTech funding deals in Europe for a total of €269.4m;

Congratulations to the German ESG platform IntegrityNext for its €100m Venture round, followed by online marketplace Raisin in a €60m Series E.

REPORT

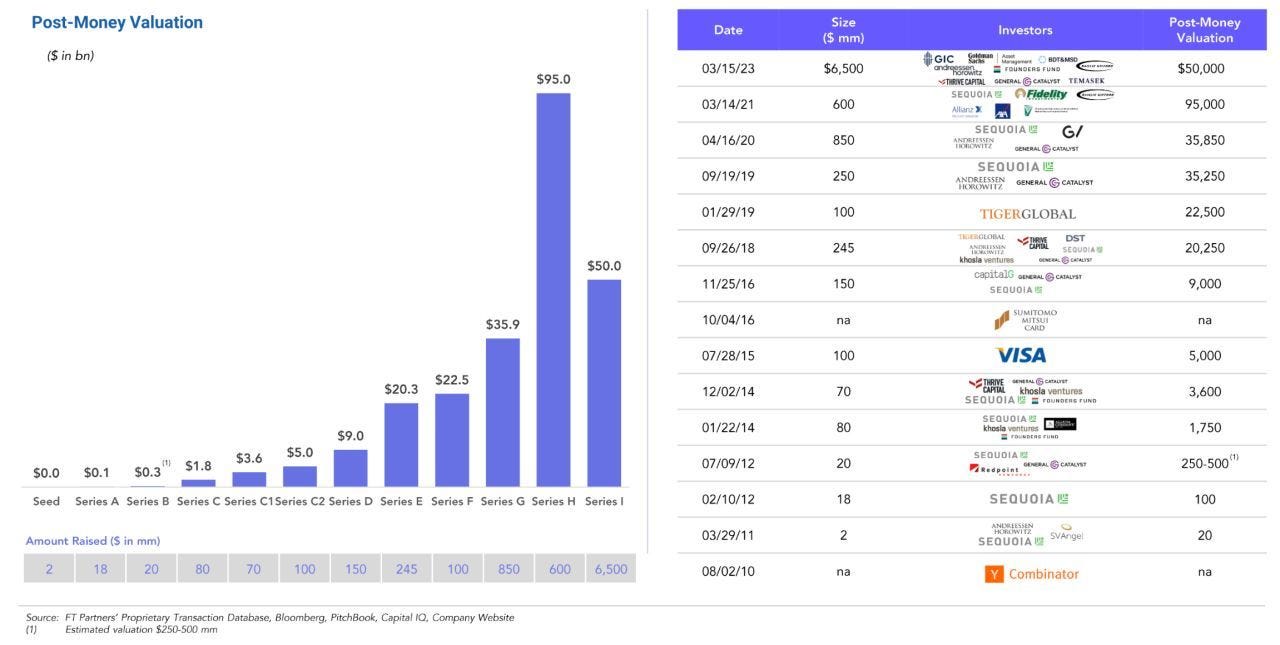

Stripe raises $6.5 billion in Series I financing valuing the Company at $50 billion – this represents a nearly 50% decline from the $95 billion valuation following its Series H round in March 2021.

👀 NEWS HIGHLIGHT

PhonePe reportedly called off its deal to acquire ZestMoney over concerns related to due diligence. The acquisition deal was pegged at $200 million-$300 million.

The move is seen as a major blow to the BNPL platform, which is backed by Goldman Sachs, PayU, and Xiaomi among others.

📰 ARTICLE

FinTech investment hit the brakes in 2022; funding into the European sector dropped by a third to $19.2bn, down from $28.9bn in 2021, according to CB Insights.

Among Europe’s most prolific FinTech angel investors in the past 15 months are several familiar faces — including the founders of Monzo, Checkout, and GoCardless.

📊 INFOGRAPHIC

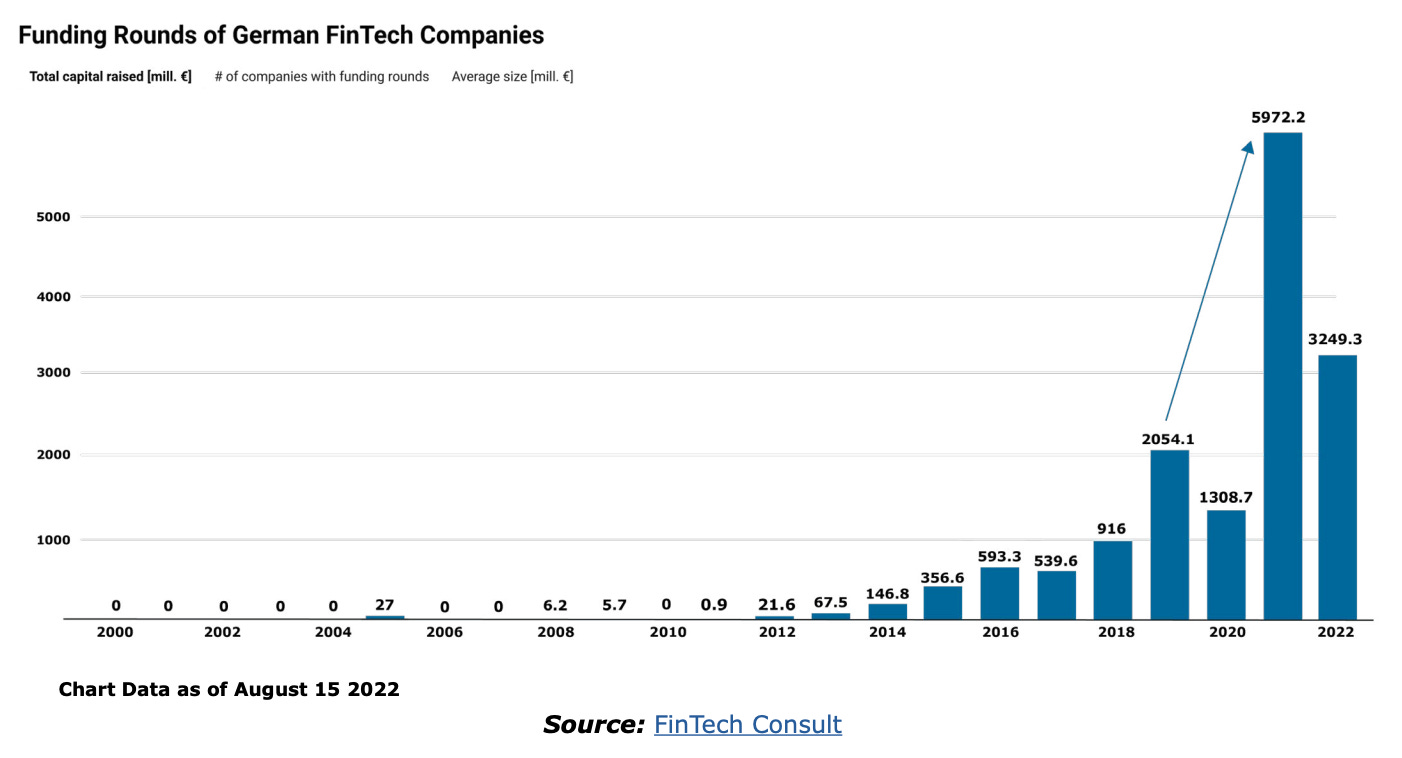

With nearly 1,000 fintech startups, among which 13 unicorns, a burgeoning startup ecosystem and a supportive regulatory and political landscape, Germany has become one of the world’s top fintech markets and the European Union’s fintech leader.

💰 VC FUNDS

Camel Ventures launched an EGP 500 million Venture Capital Investment Vehicle, dubbed Camel Ventures for Investment I, focused on financing Egypt's growing fintech startup ecosystem.

🤝 M&As

Zenus Bank acquired FUEX Payments, a fintech specializing in real-time payments for the Caribbean and Latin American markets.

Sumitomo Mitsui Financial Group inked a deal to acquire a 15% equity stake in VPBank for approximately US$1.5 billion.

LoanTap acquired Unofin for an undisclosed sum to aims to leverage Unofin's expertise in healthcare financing.

ReAlpha acquired a complementary real estate tech startup called the "Robinhood of real estate", Columbus' Rhove.

Ingenico acquired smartphone payment acceptance fintech Phos for an undisclosed sum.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🎉 NOTABLE FUNDING ROUNDS

⭐️ StellarFi raised $15 million in new funding.

⭐️ ArK Kapital extended its capital pool to €400 million.

⭐️ Agreena announced its Series B raise of €46M, led by Germany’s leading multi-stage investor HV Capital.

UK 🇬🇧

Nationwide Building Society, Wells Fargo, and Intesa Sanpaolo invest $9m in Hazy.

Connect Earth just raised over €5.1 million and now plans to scale across Europe and the US.

Paytrix raised an $18.3 million Series A funding round which will drive product development and international expansion, the round was co-led by Unusual Ventures, Motive Partners and more.

Clim8 is shutting down and looking for a buyer but says shareholders will likely lose money in a potential sale.

Bink raised £9m in a fresh funding round by existing investors in Loyalty Angels.

Finverity raised US$5 million in a heavily oversubscribed equity funding round from Outward, Acrobator Ventures and s16vc and more.

EUROPE 🇪🇺

HeavyFinance raised €3 million during its seed funding round to drive a major expansion, accelerating its sustainable finance options from Practica Capital.

NPEX BV raised €2M in a fresh round of funding and will use the funds for the platform’s growth moving forward and open up more opportunities for SMEs.

Open Payments closed a €3 million growth round led by Industrifonden with support from Japan's Sony Financial Ventures, Global Brain and existing investors.

Tenity announced the first closing of its Tenity Incubation Fund I with investments from SIX Group, UBS Next, Julius Baer, and Generali’s House of Insurtech Switzerland.

LI.FI raised $17.5m in a Series A fundraise co-headed by CoinFund and Superscrypt.

USA 🇺🇸

Mastercard made an equity investment in Paypa Plane, joining Commonwealth Bank on the register as new payment functionality known as PayTo.

Sezzle filed with the SEC to register shares in preparation for a direct listing on Nasdaq.

Zorro secured $11.5m seed round, the investment was co-led by Israel-based venture capital firms Pitango and 10D.

Spiral raised $28 million to launch its 'Impact-as-a-Service' platform designed to help banks and fintechs embed sustainability and social impact into their businesses.

Infinant secured $5 million in financing to help it launch its platform designed for banks, according to a U.S. Securities and Exchange Commission filing.

ASIA

Thunes received a $30 million investment from UK-based hedge fund Marshall Wace, as disclosed in a recent filing with Singapore’s Accounting and Corporate Regulatory Authority.

Nimbbl raised $3.5 million across seed and pre-series A rounds from financial services platform Groww, Sequoia Capital India and Global Founders Capital.

Advance which helps employees get early access to their salary, raised $16m in its pre-Series A funding round.

AFRICA

Payday announced a $3M seed round, led by Moniepoint, with participation from HoaQ, DFS Lab’s Stellar Africa Fund, Ingressive Capital Fund II and more.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.