REPORT

👀 NEWS HIGHLIGHT

This is the first transaction that Prodigy has closed under their new multi-issuance special purpose vehicle structure.

The joint initiative between Prodigy Finance and their funding partners represents a significant commitment to providing accessible financial support to aspiring masters students from around the world.

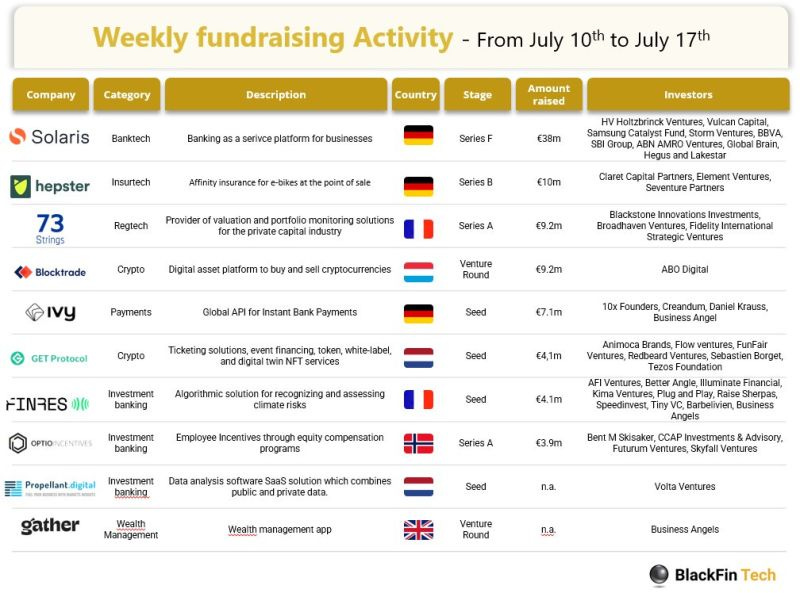

📊 INFOGRAPHIC

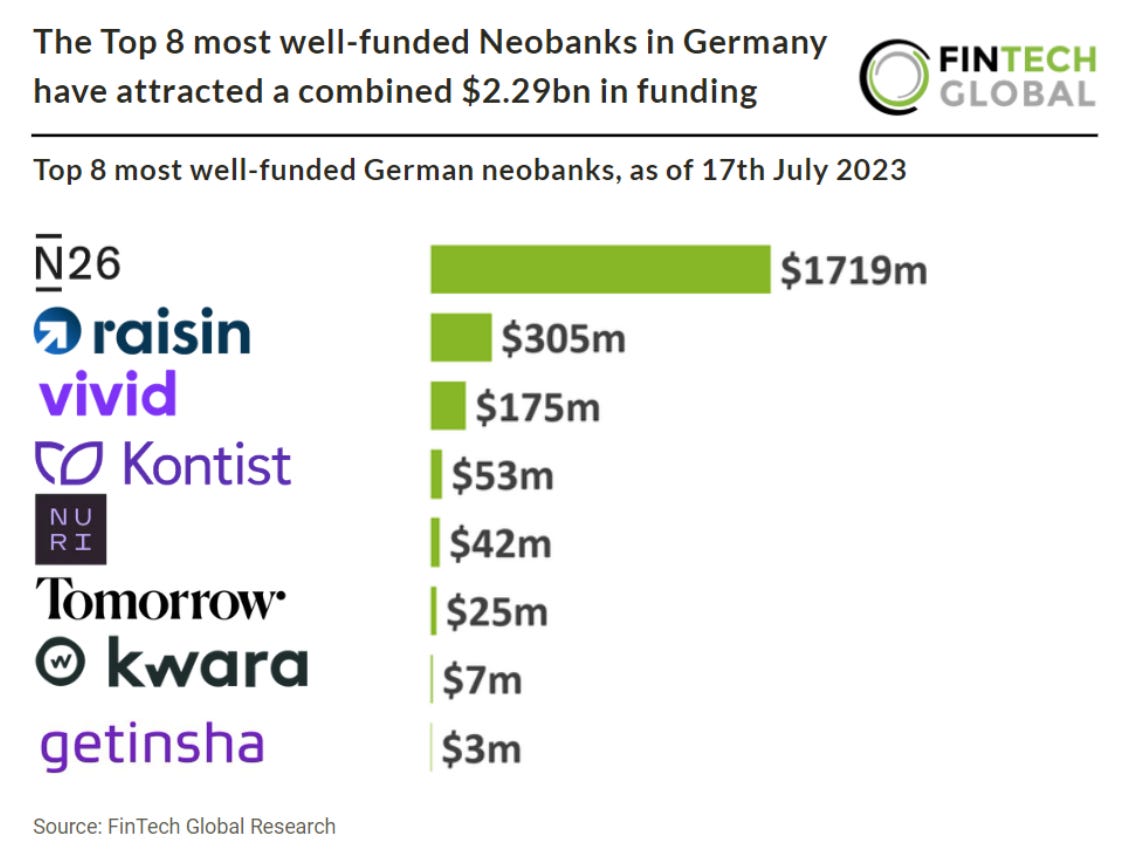

German neobanks have grown in popularity within the country and has the second largest neobanking transaction value which reached $50 billion in 2021.

Despite the increasing prominence of open banking and the integration of digital-only neobanks into the European Union's financial landscape, these FinTechs have encountered challenges in achieving sustained profitability.

💡INSIGHTS

With the market having changed dramatically since the heyday of 2021’s venture funding boom, fintech valuations have largely shifted accordingly.

🤝 M&As

HyperPay acquires Sanad Cash. This strategic move aims to bolster HyperPay’s service offerings and solidify its standing as a comprehensive all-in-one digital solution across the MENA region.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🎉 NOTABLE FUNDING ROUNDS

⭐️ Gondi goes live, raises $5.3M round led by Hack.vc.

⭐️ Portrait Analytics raises $7m for launch of AI research platform.

⭐️ Ex-Swile and Qonto product chiefs raise €5m for new fintech Pivot.

⭐️ Bureau extends series A funding to $16.5m.

UK 🇬🇧

Sylvera has raised a $57m Series B funding round. The new cash will be used for international expansion into the US. It will also make further investments in its UK engineering and product teams.

TP24 has raised £345m in debt funding from UK parties Barclays Bank Plc (“Barclays”) and M&G Investments.

EUROPE 🇪🇺

Hepster has raised €10m Series B as it looks to expand to new markets and work towards profitability.

Channel and Citi provide €230 million credit facility to SME lender Silvr. This will increase Paris-headquartered Silvr's financing capacity, which is instrumental in its gradual expansion into Europe.

73 Strings scoops $10 million in Series A funding. 73 Strings will use the capital to continue to invest in building the product, engineering, and go-to-market teams.

Kuflink, an alternative lender has raised a £35m of institutional debt facility from European Risk Capital and Paragon Bank.

USA 🇺🇸

Trunk Tools announced its launch out of stealth with $9.9 million in seed funding. The infusion of capital will fuel the company’s growth by expanding its talented team, helping accelerate the development of its unique output-focused incentives solution.

RightRev raised $12M in funding. The company intends to use the funds to accelerate its growth and expand its revenue accounting offerings. RightRev plans to invest in product innovation, including integrating with Billing solutions and ERPs.

Anduin announced they have raised $15.6 million in Series B funding. 8VC led the round with participation from existing investors and GC1 Ventures.

Karat Financial raises $70 million Series B to upgrade its creator credit card business.

LATAM

Mattilda grabs another $19M, this time to expand beyond Mexico’s private schools.

Regcheq Raised USD $2M to Expand into Brazil and Mexico.

Culttivo raised a $15mn round through a FIAgro credit receivables fund (FIDC) from Octante Capital.

ASIA

Thunes extends Series C funding to USD $72m with support from Visa, EDBI and Endeavor Catalyst.

Orderfaz today announced the completion of an undisclosed pre-seed financing by 1982 Ventures. Orderfaz plans to hire more staff across all functions with this financing round to further platform development and market expansion.

Salmon announced that it has raised a US$ 20 million debt facility from U.S.-based emerging-markets specialist investment firm Argentem Creek Partners. This will enable Salmon to further scale its lending operations across the Philippines.

AUSTRALIA 🇦🇺

Lumi has successfully completed a $15 million capital raise with the aim of accelerating the company’s growth. This capital infusion will be strategic for the company’s growth and expansion.

TP24 lands A$585 million global debt deal with Barclays. The funding will be used to enable TP24 to support more Aussie businesses grow, export, and create jobs.

AFRICA

Flash has closed a $6 million seed funding round. The capital injection will be used to accelerate the startup's product development and customer & business acquisition in Egypt.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.