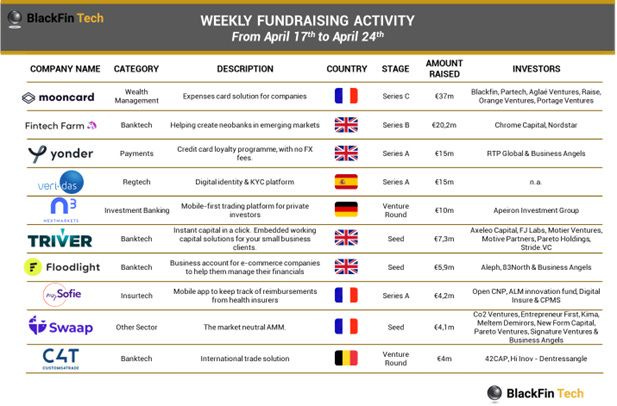

WEEKLY FUNDRAISING ACTIVITY

Last week we spotted 19 European FinTech Funding deals for a total amount of €129m;

️

⚫Top 1O Fintech Financing and M&A deals

The 5 biggest FinTech fundraisings this week are more diversified than usual, 3 located in Europe and 2 in the US over three verticals; Crypto & Blockchain, Banking, Lending and Payments👇

REPORT

Here are some key takeaways from Royal Park Partners’s Q1 2023 – FinTech market update:

The deal count also increased from 176 to 215.

Stripe’s $6.5bn Series I attracted the spotlight as it nearly halved its valuation to $50bn.

In February, Coupa’s $8bn buy-out by Thoma Bravo represented one of many deals that have happened recently in the increasingly active spend management space. It represented 63% of the total M&A value of this quarter.

In March, MAX’s acquisition by CLAL Insurance & Finance for $687m was the most notable transaction.

Read and download the full report through the link below 👇

👀 NEWS HIGHLIGHT

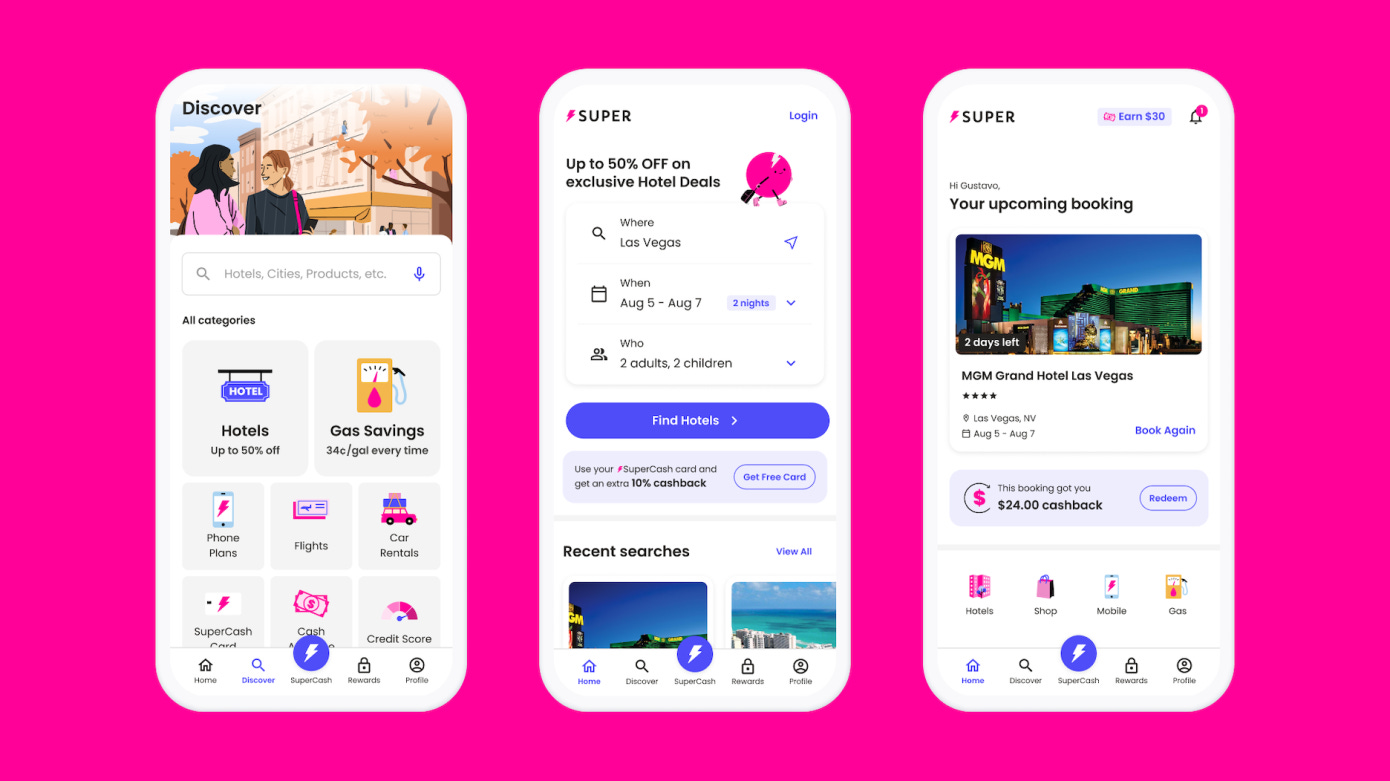

Super.com launched its cashback card SuperCash last October so that card users could build credit, amassing 5 million customers worldwide who have collectively saved over $150 million to date.

📊 INFOGRAPHIC

PayTech accounts for 9.7% of global FinTech deals in Q1 2023. Key PayTech investment stats in Q1 2023:

PayTech accounted for 9.7% of global FinTech deals in Q1 2023 with 132 deals.

The PayTech subsector raised $8.1bn in total during Q1 2023, a 37% share of FinTech investment.

The US was the most active PayTech country with a 36% share of deals at 47 deals.

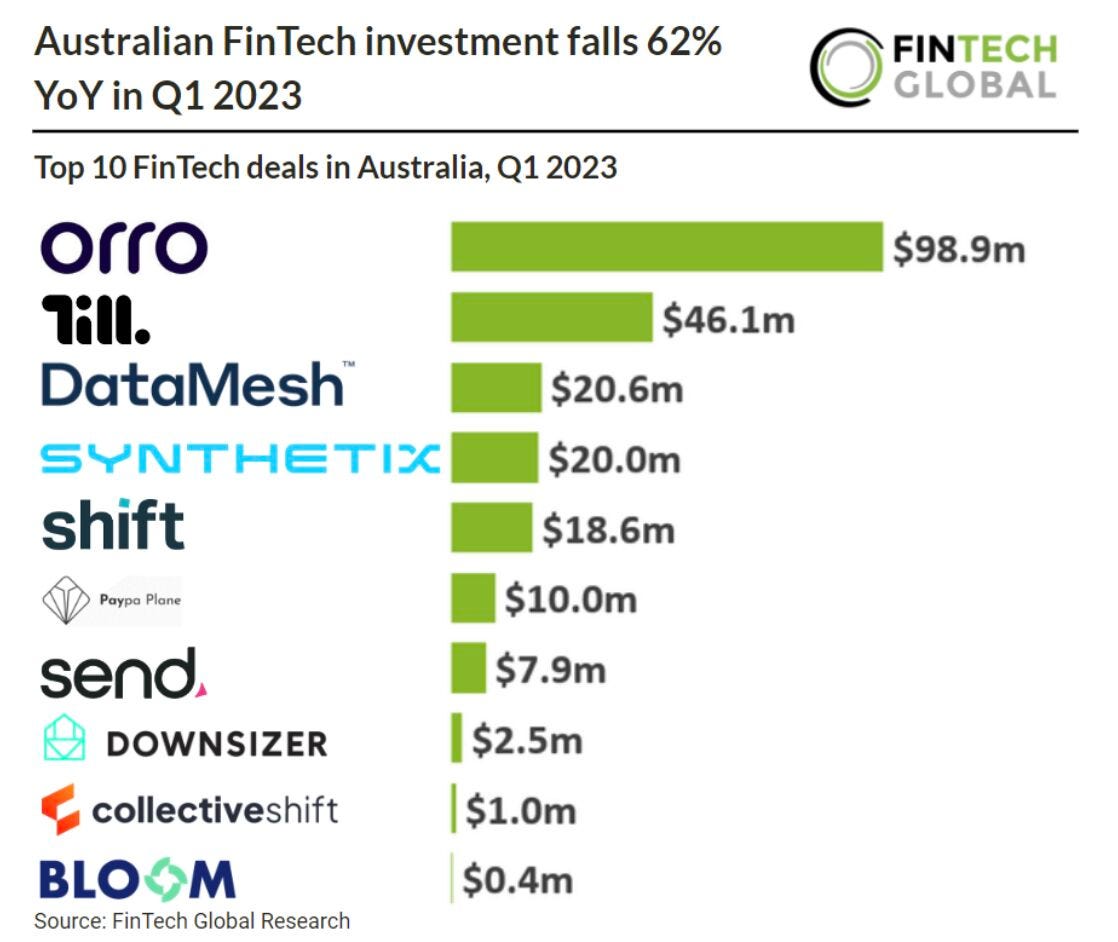

⚫️ Australian FinTech investment falls 62% YoY in Q1 2023. Key Australian FinTech investment stats in Q1 2023:

👉 Australian FinTech deal activity reached 22 deals in Q1 2023, a 56% drop from Q1 2022.

👉 Australian FinTech funding ended the quarter at $226m in Q1 2023, a 62% decline compared to the same period last year.

👉 PayTech and RegTech were the most active FinTech subsectors in Australia during Q1 2023.

🤝 M&As

GoSimpleTax is set to acquire Coconut to create an end-to-end bookkeeping and filing solution for individuals and small businesses.

Founders Forum Group acquired Tech Nation, rescuing the quango from oblivion after a decade of championing UK startups.

Belvo acquires Skilopay to further develop its strategic position as a leading account-to-account payments provider in Brazil and Latin America.

Kakao Pay acquired a stake in Siebert Financial. Kakao spent $17 million on this transaction and the company now owns a 19.9% stake in Siebert.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🎉 NOTABLE FUNDING ROUNDS

⭐️ Zodia Custody closed a $36m Series A funding round led by SC Ventures and SBI Holdings.

⭐️ Clara extended its Series B funding round with a $60 million investment from GGV Capital.

⭐️ Summer raised $6 million in new capital, totaling $18 million in funding to date.

⭐️ Plumery raised a €2m equity and €2.3m convertible debt seed round.

UK 🇬🇧

Fintech Farm raises $22 million in a Series B funding round led by Nordstar Fund as well as with participation from Chrome Capital.

About $15 billion has been wiped from the valuation of Revolut by one of its most loyal shareholders Schroders.

42Markets Group received a $10m growth investment from Convergence Partners, which will help 42Markets accelerate the development and expansion of its portfolio companies.

Tembo raised £5 million from Lone Ventures and Starling Bank backer Harold McPike.

EUROPE 🇪🇺

Nalo secured a new funding deal, which was led by Mandalore Partners, an asset manager focused on insurance and savings. The size of the deal was not disclosed.

Bastion Cyber raised €2.5 million in seed funding from Kima Ventures, Frst, Global Founders Capital, and others.

USA 🇺🇸

Credora raises $6 million in a funding round led by S&P Global and Coinbase Ventures.

IDPartner raised $3.1 million in a seed funding round led by Abstract Ventures. Foundation Capital, Circle Ventures, and others also joined the round.

Anthemis Group completed a restructuring that resulted in its letting go of 16 employees, or about 28% of its employees, earlier this year.

LATAM

Habi announced that it has entered into a US$100 million credit facility with Victory Park Capital to bring more innovation to the sector.

ASIA

Kaspi.kz is preparing for a U.S. listing, as it reported its adjusted first-quarter profit jumped by 52% year on year to 178 billion tenges ($389 million).

Niro reportedly secured $11m in its Series A funding round. The investment included $8.5m in equity and $2.5m in debt.

MIDDLE EAST

Vesey Ventures closed its debut fund of $78m. Its maiden fund will invest in early-stage FinTech companies where opportunities for early partnerships with financial incumbents exist.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.