REPORT

This week’s chart by Royal Park Partners is dominated by US deals as they occupy 6 positions within the Capital Markets, Wealth Management and Other FinTech space👇

WEEKLY FUNDRAISING ACTIVITY

Last week we spotted only 9 European FinTech deals for a total amount of €49.6m raised;

👀 NEWS HIGHLIGHT

Yonder raised a £62.5m Series A round of funding, boosting its valuation nearly three times to £70m.

The cash, which is split between £12.5m of equity and £50m of debt will be used for a growth push including scaling the company’s headcount by c.100%to 35 people and expanding into new UK cities.

😎 SPONSORED CONTENT

The Integrated solutions for startups and SMEs, with more than 45k merchants, achieving more than 1 million transactions per day worth $11 million

💡INSIGHTS

Key Highlights from Global FinTech investor activity during Q1 2023:

👉 2432 investors invested in FinTech companies during the first quarter

👉 A combined $22bn was raised by FinTech companies in Q1 2023

👉 Overall, 1,366 FinTech deals were announced globally in Q1

💡INSIGHTS

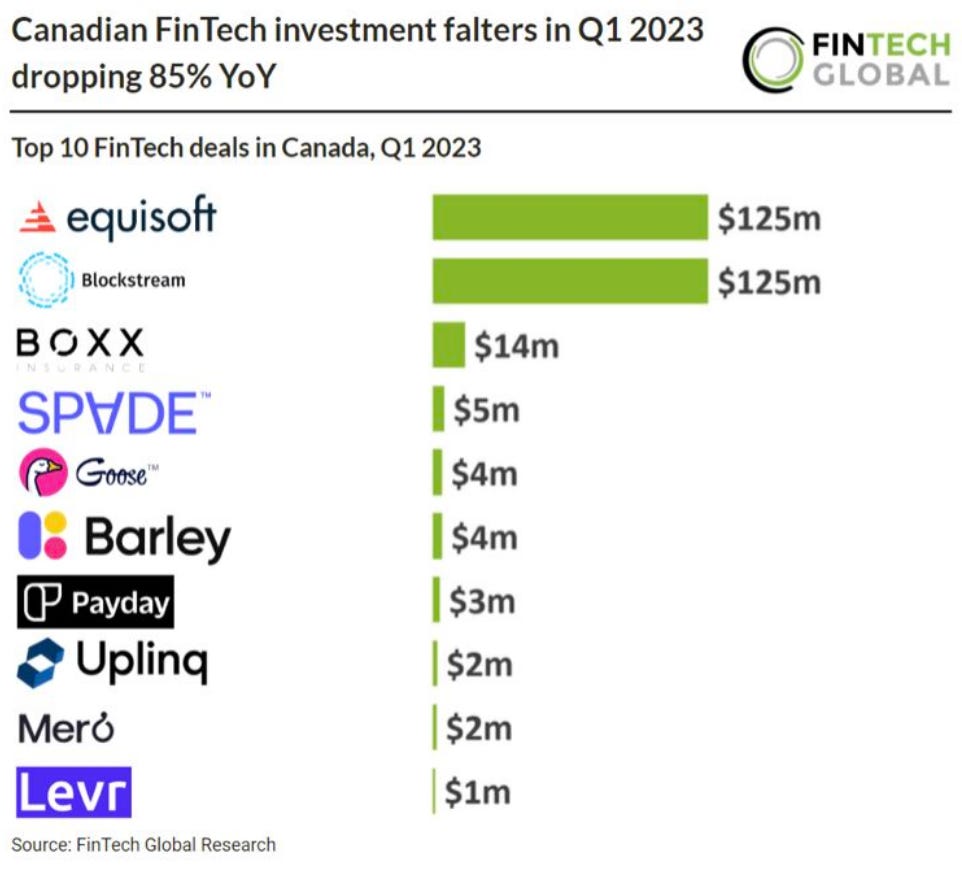

Key FinTech investment stats in Canada Q1 2023:

Canadian FinTech companies in Q1 2023 raised a combined $286m in the first quarter of 2023, an 85% drop YoY.

Canadian FinTech deal activity reached 35 deals in Q1 2023, a 48% drop YoY.

🤝 M&As

Caxton Payments and ParentPay announced a major agreement. Caxton acquired the entire operating business and share capital of Nimbl.

Ryan Reynolds acquired a stake in Canadian payments firm Nuvei. The size of the investment was not disclosed.

Razor Group acquired one of its competitors in the aggregator space, Stryze Group, as part of a bid to be “the consolidator of consolidators.”

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🎉 NOTABLE FUNDING ROUNDS

⭐️ Waave raised $4.7 million in a Seed round by a range of prominent individuals, including Menulog boss Morten Belling.

⭐️ Factris scored €50m in global funding from global investment business Aegon Asset Mangement.

⭐️ Rally picked up $12 million in Series A investment. This investment follows Rally’s $6M seed funding round in 2021.

⭐️ Clerkie scored $33m in a Series A round headed by Left Lane Capital.

UK 🇬🇧

Floodlight raised a $6.4M seed funding round. The round was led by Aleph, and 83 North, with contributions from Christopher North.

Triver raised $8 million in funding. The company raised funding pre-product and wants to automate SME invoicing.

EUROPE 🇪🇺

A unit of Allianz SE put its stake in German online bank N26 up for sale at a steep discount, valuing the lender at $3 billion.

Hokodo and Digital Trade Credit solutions announced a Series B extension from Citi, a global leader in financial services. This extension comes less than 10 months after Hokodo announced the Series B funding in June 2022.

USA 🇺🇸

Unchained Capital raised $60 million in a Series B funding round led by Valor Equity Partners. NYDIG, Trammell Venture Partners, Ecliptic Capital, and Highland Capital Partners joined the round.

Charm Solutions raised $3.5 million in a seed round led by BootstrapLabs. The firm recently formed a partnership with Abrigo.

Rally secured $12m in a Series A investment round. The funding will help Rally further strengthen its team, penetrate enterprise and international markets.

Stratyfy announced $10 million in funding last month. The round was co-led by Truist Ventures and Zeal Capital Partners.

LATAM

Kala raised US$6M to continue in its mission to digitalize the credit experience in Latam. The company is developing a vertical SaaS product for institutions, that want to launch and operate their own credit products.

Payfy founded by André Apollaro and Matheus Carvalho Anzzulin recently raised USD $800K in a seed round led by BB Ventures.

ID Finance secured a $30 million debt facility from SR Alternative Credit, an affiliate of Spouting Rock Asset Management. The company aims to use this significant investment to continue to support the growth of its consumer lending business in Mexico.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.