#DoneDeal FinTech Funding News | 2023 #34

Weekly Funding news up to Friday, 25th of August 2023

REPORT

🌱 European FinTech seed deal activity in 2023 on track to beat 2022’s levels.

Key European FinTech seed investment stats in H1 2023:

‣ European FinTech seed deal activity is on track to reach 714 deals in 2023, a 5.1% increase YoY

‣ European FinTech seed deal activity reached 184 deals in Q2 2023, a 6.3% rise from Q1 2023

‣ The UK was the most active seed deal country in Europe during H1 2023

👀 NEWS HIGHLIGHT

Both parties declined to reveal valuation details for the deal but Lender & Spender is currently originating c.€200m annually and has 32 employees, according to LinkedIn.

The two companies have had a partnership since last year.

M&A deal-making has been long expected to increase in the fintech sector, with 2023 seeing a heightened level of interest.

💡INSIGHTS

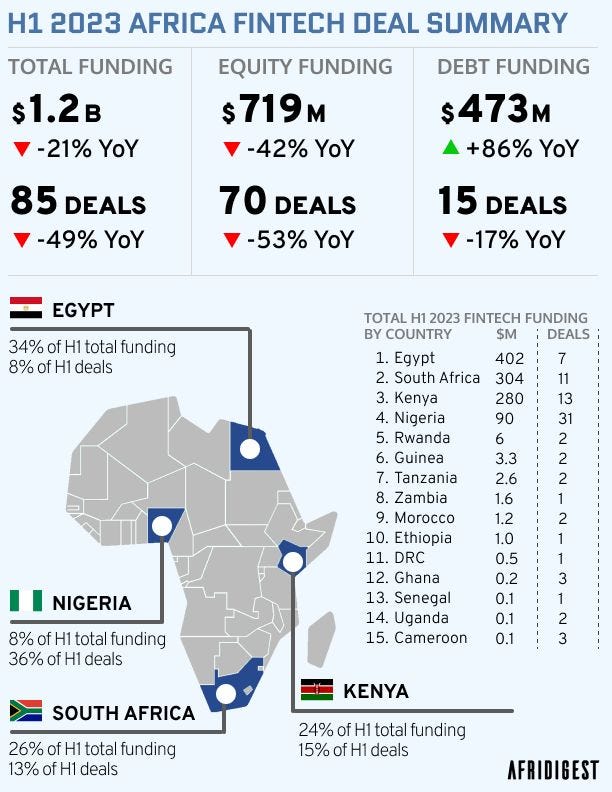

Here’s a quick summary of FinTech funding in Africa in the first half of the year:

In the first half of 2023, 75 FinTech startups in Africa announced raising ~$1.2B in risk capital across 85 transactions.

That’s an average of 14 deals and ~$200M in funding raised per month.

And while the total amount raised was down 21% from H1 2022, there’s a bit more nuance to the story.

Funding levels in Ireland's fintech sector have fallen again in the last 12 months due to economic and geopolitical challenges.

According to data from KPMG, there were nine fintech investment deals completed in the first half of 2023, raising a total of $59.2m.

Kenya is among the top three countries in Africa with the bigger portion of fintech funding in the first half of 2023.

According to Afridigest Fintech Transactions Database, Kenya’s share of the fintech funding in the first-half of 2023 stands at USD280 million from 13 deals, Egypt and South Africa are leading at USD 402 million and USD 304 million from seven and eleven deals respectively.

🤝 M&As

Velo Payments has announced the acquisition of the payment processing platform YapStone in order to offer its customers improved payment methods.

OANDA Global Corporation announced that it has acquired a majority interest in Coinpass Limited. This acquisition will complement OANDA's existing strengths in offering a wide range of CFD instruments.

Yahoo has acquired Commonstock, a social platform that lets retail investors link their brokerage accounts and share their portfolio's performance and discuss their trades and strategies. Terms of the deal were not disclosed.

Datasite acquires MergerLinks. The acquisition supports Datasite’s strategy to be the home of M&A. Financial terms are not being disclosed. MergerLinks and its management team are operating as a strategic product unit within Datasite.

🛳 PARTNERSHIPS

Dock announced a partnership with Feedzai to provide new options for security solutions to Dock customers and expand access to this cutting-edge technology in Latin America to companies of all sizes.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🎉 NOTABLE FUNDING ROUNDS

⭐️ Ramp announces $300 million in new funding to accelerate expansion, hiring, and product roadmap.

⭐️ European Investment Fund backs SME Finance to the tune of €40 million.

⭐️ Maple Finance raises $5M to enter Asia amid regulatory clarity.

⭐️ Bolt's Ryan Breslow seeks to raise the next "Founders Fund".

EUROPE 🇪🇺

CityPay.io has raised a Seed funding round of more than €2 million, which includes $500k investment in cryptocurrency. Funding will help escalate the expansion into CIS region and other markets, as well as see the development of a B2C platform.

USA 🇺🇸

Veza announced that it raised $15 million in a funding round led by Capital One Ventures and ServiceNow. Proceeds will be put toward product development, expanding Veza’s sales capacity and supporting its go-to-market execution.

BitGo was able to lock in an even higher valuation from investors, raising a $100 million Series C at a $1.75 billion valuation.

ClassWallet draws $95M in funding. The funding will support the company’s ongoing growth in enabling government agencies, particularly those in education, to digitally manage their finances.

LemFi raises $33 million to bring free remittance payments for global migrants.

Momnt raises $15M to expand lending platform. Momnt provides loans to consumers for health care and home improvement projects.

LATAM

Mitfokus recently secured additional funding from Bossanova Investimentos and some angel investors. The company plans to expand its accounting products throughout Brazil and add new features to its application.

Fitinsurs has successfully secured its inaugural external investment from Lanx Capital during a Series A funding round. The newly acquired funds will primarily drive the enhancement of new features, solidify the application of generative artificial intelligence, and foster team growth.

Munchies, aiming to become a digital bank for decentralized finance in Brazil, received an undisclosed sum in presSeed investment from Canary and Latitud. The company doesn’t manage assets, but will offer DeFi products.

Nomad receives US$61M investment to expand its customer base. The new fundraising will be used, according to the company, to continue expanding the number of clients.

Citi has made a strategic investment in Peruvian foreign exchange fintech Rextie. The investment will also see Citi’s FX technology integrated into Rextie’s currency exchange services.

ASIA

Vegapay has successfully secured $1.1m in a pre-seed funding round. With these new funds, Vegapay has set its sights on refining its technology to simplify frontline adoption for both institutions and non-institutions.

Boost Capital lands US$2.5M for its chat-based bank client onboarding platform. The firm will use the funds for market expansion, enlarging its product team, and initiating partnerships with new banks.

Pi-xcels has successfully completed its Seed funding round, raising US$1.7 million. The fresh funds will fuel global business development initiatives, particularly expanding Pi-xcels’ footprint in Europe.

MIDDLE EAST

Craftgate has recived a $1 million investment from Hepsiburada and UK VC D4 Ventures.

AFRICA

Zanifu has raised $11.2 million in debt-equity funding for its platform providing micro, small and medium-sized businesses with inventory financing.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.

-