#DoneDeal FinTech Funding News | 2023 #36

Weekly Funding news up to Friday, 8th of September 2023

REPORT

Spanish FinTech defies global trends in 2023, deal activity set to grow by 21%

Key Spanish FinTech investment stats in H1 2023:

‣ Spanish FinTech deal activity is on track to reach 104 transactions in 2023, a 21% increase from 2022.

‣ Spanish FinTech deal activity totalled at 52 deals in the first six months of 2023, a 16% decrease YoY.

‣ Spanish FinTech companies raised a combined $94m in H1 2023, a 51% decrease from 2022.

👀 NEWS HIGHLIGHT

The startup has picked up £75 million ($93 million), a debt fundraise that it plans to use to shore up its finances, eye up some acquisitions and continue building more products alongside its loans, savings and deposits, BNPL and other services used by its 1 million customers.

📰 ARTICLE

🚨 Revolut mafia just surpassed Revolut itself.

In just five years, 102 Revolut alumni-led startups, some of which have former Revolut employees in C-level positions, have collectively secured a remarkable $2.2 billion in funding from 184 venture capitalists (Revolut has raised $1.7B since 2015 from 52 VCs).

Among these, there are 67 startups founded by Revolut alumni, amassing an impressive $451 million in total funding from 152 venture capitalists.

💡INSIGHTS

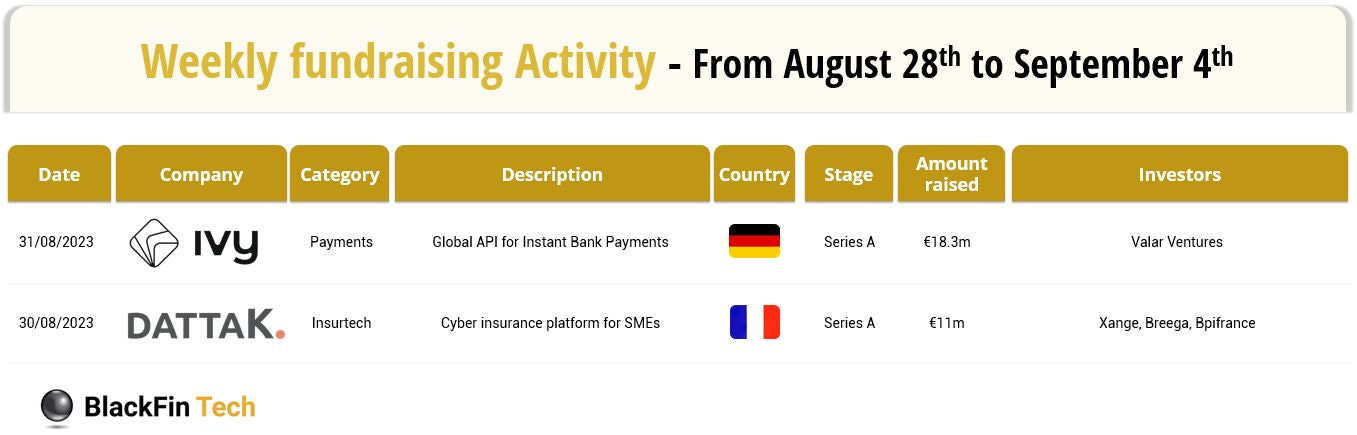

A total amount of €29.3m was raised, with one deal in Germany🇩🇪 and one deal in France🇫🇷.

Still, eight $100 million+ funding rounds and two $1 billion+ M&A deals were announced in the month – see more in FT Partners’ Infographic here.

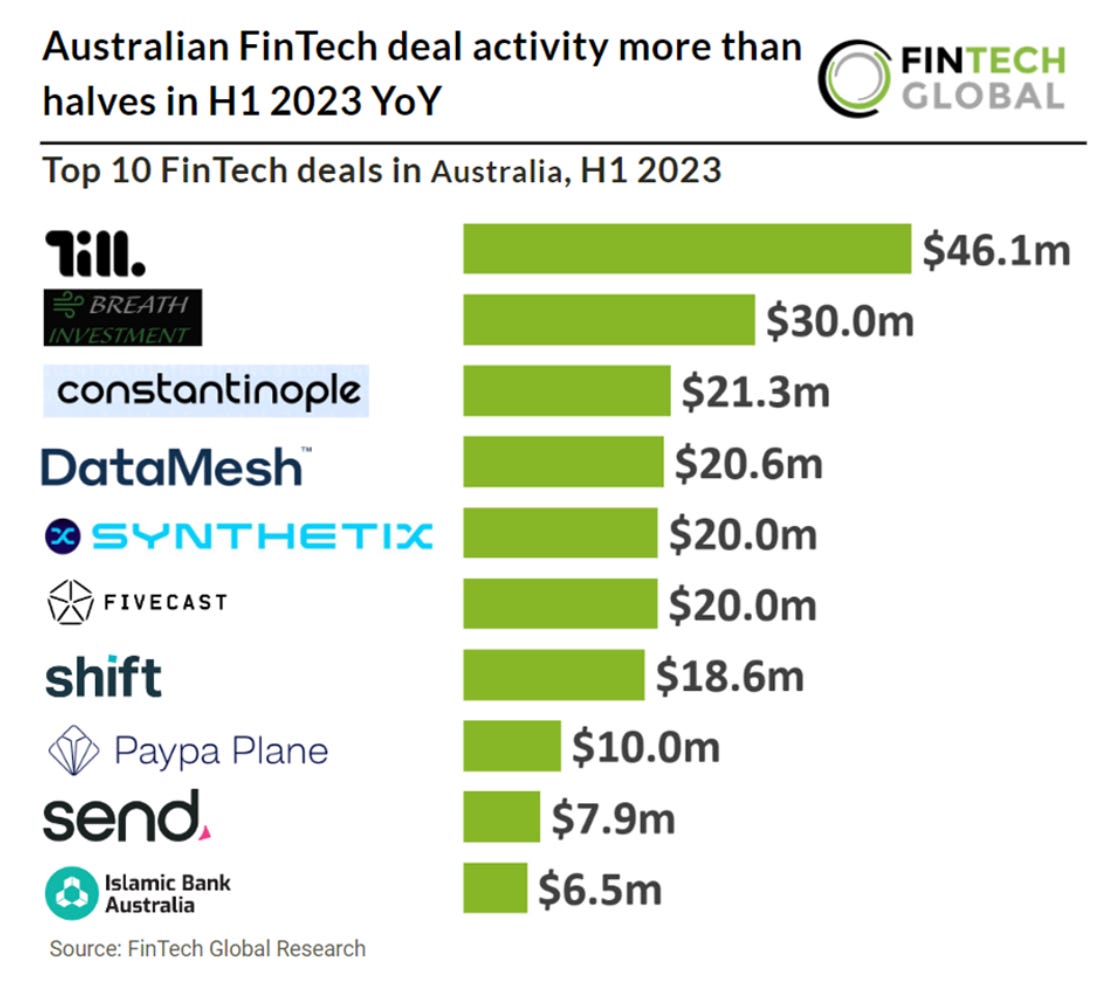

🇦🇺Australian FinTech deal activity more than halves in H1 2023

‣ Australian FinTech deal activity reached 47 transactions in H1 2023, a 55% reduction from the same period last year.

‣ Australian FinTech companies raised $239m in aggregate funding during the first six months of the year, a 69% drop compared to 2022.

🤝 M&As

Clear Junction has announced the acquisition of Altalix. This strategic acquisition represents a significant milestone in Clear Junction’s growth journey as it works towards becoming a one-stop shop for its clients to manage their payment and treasury needs globally.

Stori has obtained approval from the National Banking and Securities Commission (CNBV) to acquire the license of the popular financial institution MasCaja.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🎉 NOTABLE FUNDING ROUNDS

⭐️ Friday Finance acquired by competitor Pliant in a strategic shift.

⭐️ CBA's x15ventures to acquire Waddle.

⭐️ Wayflyer secures $1bn financing from Neuberger Berman.

⭐️ Saxo completes sale of fintech joint venture to Geely Group.

⭐️ Brine Fi is unveiling a $16.5 million funding round that values the business at $100 million.

EUROPE 🇪🇺

Point72 Ventures has led a $15m Series A investment round in asset securitization fintech GenTwo. The funding will be used to support international expansion and invest further in the GenTwo financial engineering platform.

Strise announced that it has secured $10.8M (nearly €10M) in a Series A round of funding. Strise plans to use the funds to expand internationally, starting with the UK, and target customers in finance, insurance, legal, and other sectors.

Treyd secures €11.2 million in extension of Series A to achieve profitability. The new capital will be used to grow existing markets, invest in the core product offering, and work towards achieving profitability.

USA 🇺🇸

Parallel announced it has raised $1.85M in Pre-Seed funding. The round was led by Penny Jar Capital. Also participating in the round are Utah-based investors: Convoi Ventures, Peak Capital, Frazier Group, and other unnamed investors.

Momnt is announcing the closing of its latest capital raise, totaling $15 million. Momnt will utilize the new capital to continue investing in its people, processes, and technology, further improving Momnt’s best-in-class platform.

Trident Digital Group raised $8 million for its “next generation” crypto lending business.

SimpleClosure raises $1.5M in less than 24 hours to help companies shut down faster and cheaper.

LATAM

Lightspeed Venture Partners is making its debut investment in Brazil by leading a seed round for Cumbuca, a fintech aiming to redefine joint accounts.

ASIA

MFast successfully raised USD 6m in a Series A funding round led by Wavemaker Partners, with the participation of two new investors Finnoventure Fund I (managed by Krungsri Finnovate) and Headline Asia, along with other investors.

MIDDLE EAST

ThetaRay has completed a $57 million fundraising round. The new funding will be used to accelerate global growth plans and capitalise on surging demand for new AI-based technologies in the $9 billion financial crime fighting market.

myZoi has raised USD 14 million from SC Ventures and SBI Holdings, as it obtains two regulatory licenses from the Central Bank of the UAE.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.

-