REPORT

Last week we saw 12 FinTech deals in Europe for a total amount of 103M €

Let’s dive in👇

There were 5 deals in the UK🇬🇧, 3 in France🇫🇷, 2 in Italy🇮🇹 and 1 in Estonia🇪🇪 and in the Netherlands🇳🇱.

At $27 Bn, the Indian Fintech sector was the second biggest recipient of VC funds between 2014 and June 2023 and accounted for 19% of the total $141 Bn raised by Indian startups during the period.

👀 NEWS HIGHLIGHT

The company has also agreed to a multi-year extension of its existing term loan facilities and closed a new term loan facility for up to $20m of incremental commitments with Trinity Capital Inc. a provider of diversified financial solutions growth-stage companies. In addition, Petal has raised more than $20m in new equity financing from its existing investors.

These new sources of capital provide Petal with substantial fuel to expand the Petal credit card program, which provides access to high-quality Visa® credit cards (issued by WebBank) to consumers who are new-to-credit, without requiring established credit scores to qualify.

💡INSIGHTS

Key Australian FinTech investment stats in Q2 2023:

‣ Australian FinTech deal activity reached 17 transactions in Q2 2023, a 62% drop when compared to the same period last year.

‣ Australian FinTech funding ended the second quarter at $60m, the lowest reported quarterly figure in the past five years.

‣ CyberTech was the most active Australian FinTech subsector in Q2 2023 with four funding rounds.

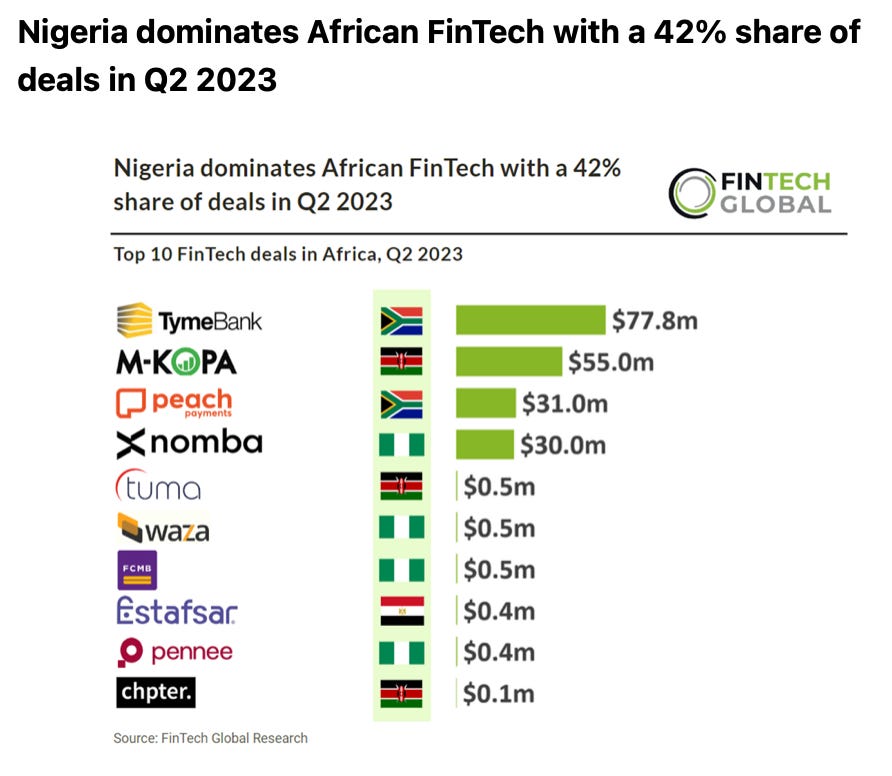

Key African investment stats in Q2 2023:

‣ African FinTech deal activity reached 59 transaction in the second quarter, a 31% drop YoY

Despite market turbulence and declining funding in both the EMEA and ASPAC regions, the Americas saw fintech funding climb from $28.9 billion in H2’22 to $36 billion in H1’23.

At mid-year, funding in logistics and supply chain-focused fintech was well above all previous annual totals ($8.2 billion), while the $1.7 billion funding in ESG-focused FinTech was ahead of 2022’s total.

Top 10 European FinTech Funding Deals for July 2023👇

Here are the Key Takeaways /Funding Stats:

𝗝𝘂𝗹𝘆 𝟮𝟬𝟮𝟯

# deals for the period: 𝟱𝟮 (-35% compared to July 2022)

‣ Total Amount raised: 𝟰𝟳𝟯.𝟴𝗺 (-76%)

‣ Total Amount raised by top 10 Deals: 347.2m (-78%)

‣ Average Amount raised: 11.3m (-60%)

‣ Median Amount raised: 4.54m (-9%)

🤝 M&As

Stavvy announced its strategic acquisition of Brace. Through this strategic acquisition, the collective team and technology solidifies its position as a servicing leader, providing a more dynamic and streamlined experience for both servicers.

Rapyd announced the acquisition of PayU. The acquisition is a strategic move that continues the company’s global expansion across emerging markets in Central and Eastern Europe and Latin America.

Priority completes acquisition of Plastiq with the approval of the United States Bankruptcy Court for the District of Delaware.

Wellfield Technologies, Inc. announced that it has signed a definitive agreement with Brane Inc. and Big Index Inc., to acquire all of the issued and outstanding securities of Brane Trust Company Ltd., and certain other assets.

Payoneer acquires data platform Spott. Spott’s technology will enable Payoneer to better understand and serve customers, which supports its mission to make it easier for SMBs to operate and grow their business around the world.

WiserAdvisor has announced the acquisition of Indyfin to build on its existing product suite and create a comprehensive growth platform for financial advisors.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🎉 NOTABLE FUNDING ROUNDS

⭐️ AngelList expands into private equity with acquisition of Nova.

⭐️ Safaricom cleared to invest in startups.

⭐️ Vanquis Banking Group acquires money saving app Snoop.

⭐️ Nexi has acquired a 30% stake in Computop for an undisclosed sum.

⭐️ Knot API raises $10M from Amex, Plaid amid deposit war.

UK 🇬🇧

Bloom Money has raised £1 million to digitize an informal financial management system employed by ethnic communities across the world.

Orbital has raised £5M ($6.4M) in an oversubscribed growth round led by Golden Record Ventures, at an attractive valuation in which the founders are maintaining a large majority.

Pockit has raised $10 million in a growth round led by Puma Private Equity. The new funding will be used to grow Pockit's customer base and diversify its product suite, while the firm also has ambitions to expand beyond the UK.

EUROPE 🇪🇺

Piece just raised a €650k pre-seed financing round from Startup Gym. The fresh capital will enable Piece to strengthen its real estate investor community, establish the necessary technological infrastructure, and streamline operations.

Philippe Teixeira da Mota, formerly the second-in-command at the enigmatic fund Hedosophia, is launching his own FinTech fund named Shapers.

USA 🇺🇸

GlossGenius raises $28M to expand its bookings and payments platform for beauty businesses.

Novo secures $125m credit facility to provide working capital to small businesses through Novo Funding.

Lula has raised $35.5 million in a Series B funding round after experiencing a massive surge in customers.

ASIA

Toss Bank is close to raising another $154 million (200 billion won) in equity at a valuation of $2.1 billion (2.7 trillion won), and it is already planning a further $150 million round for the end of the year.

AFRICA

Emtech to advance its regtech and CBDC stack solutions with $4M led by Matrix Partners India.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.

-