WEEKLY FUNDRAISING ACTIVITY

Last week, a total amount of €58.5m was raised across 9 European FinTech deals:

Congratulations to our portfolio company HAWK:AI in a $17m Series B followed by Spanish Twinco Capital in a €9m Series C round.

REPORT

Payments are now one of the most important parts of an e-commerce business’s operation, and vital to delivering an exceptional customer experience.

It was great to contribute to Mollie’s 2023 Ecommerce Playbook – and loving the results.

REPORT

Check out Financial Technology Partners / FT Partners latest report: “2022 FinTech Almanac”, providing the most comprehensive review of global FinTech deal activity with analysis across private company financings, IPOs, and M&A transactions.

👀 NEWS HIGHLIGHT

Thrive Capital reportedly committed $1 billion in fresh capital to payments giant Stripe as part of a new investment in the works that would value the FinTech company at between $55 billion and $60 billion.

😎 SPONSORED CONTENT

Fintech Meetup ticket prices increase Friday at midnight.

Don’t miss these savings for Q1’s big new Fintech event. Join 3,000+ Attendees from 750+ Companies from across the fintech and payments ecosystem for 30,000+ double opt-in Meetings. Learn from 250+ speakers, and have fun at receptions and at the Industry Night event.

📰 ARTICLE

Minu grabbed $30 million in new funding as it continues building out its gamified and rewards features, including saving or completing financial education courses, while improving retention for employers.

💡INSIGHTS

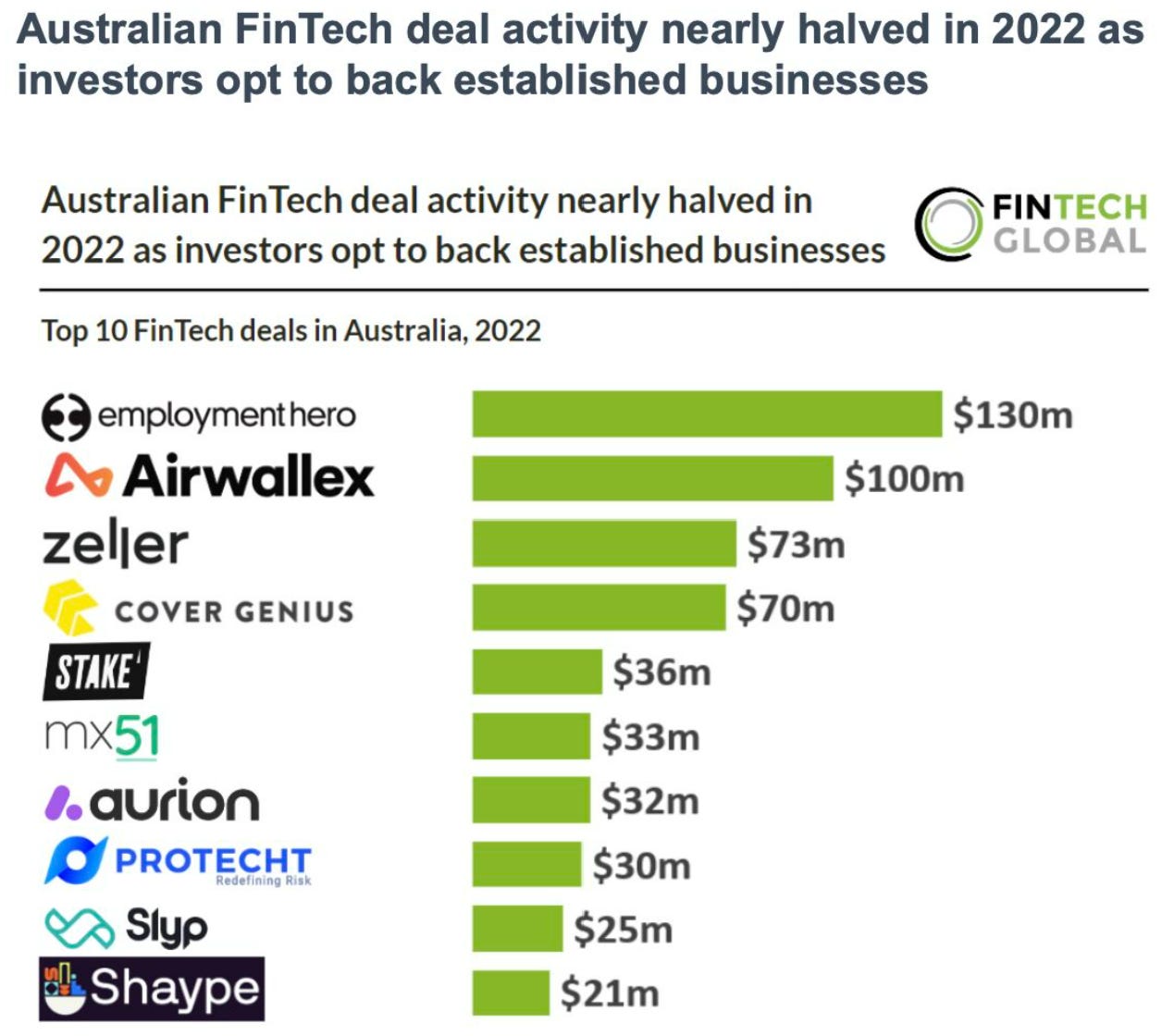

Key Australian FinTech investment stats from 2022:

👉 112 FinTech deals were announced in 2022, a 45% drop from 2021

💰 Capital invested in the country reached $1.7bn, a 55% drop from last year

🧐 ANALYSIS

European startups raised €462m across 286 seed rounds last month, a healthy figure compared with recent months.

💰 VC FUNDS

Dila Capital closed its fourth fund: US$115 Million.

🤝 M&As

Dubai Investments has acquired a 9% equity stake in Monument Bank, a UK-based challenger bank.

SendFriend acquired the assets of US compliance provider DigiPli for an undisclosed sum.

🛳 PARTNERSHIPS

FINBOURNE Technology announces its partnership with market-leading debt provider, Kreos Capital, to secure up to a £30 million debt facility.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🎉 NOTABLE FUNDING ROUNDS

⭐️ Marqeta agreed to acquire two-year-old fintech infrastructure startup Power Finance for $223 million in cash, marking the first acquisition in the publicly-traded company’s 13-year history.

⭐️ Liberis lands €30m debt financing from Silicon Valley Bank for European expansion.

⭐️ TransUnion announces investment in Bud to drive innovation and growth in Open Banking.

⭐️ Treasury Prime announced it raised $40 million in Series C funding.

UK 🇬🇧

Zopa Bank raised $92 Million. The raise from existing investors “cements” the UK fintech’s status as a unicorn with a valuation of $1 billion.

LiveMore Capital secured a credit facility of up to £250m from Citi taking total funding raised by the lender since inception to nearly £600m.

EUROPE 🇪🇺

Fagura.com closed its second round of equity investments held on the British platform Seedrs.com, raising over EUR 780,000.

Augmentum Fintech invested €3m into Berlin-based cyber insurance platform Baobab in its first venture into the insurtech space.

USA 🇺🇸

Zurp announced its pre-seed capital raise of $5M to launch the credit card for experiences.

Suppli is modernizing the construction industry with its digital payment platform for construction suppliers and announced that it closed a $3.1 million seed round.

Method Financial announced that it closed a $16 million Series A funding round.

Hatchfi launched out of beta on the heels of a $1.2M pre-seed raise with 30+ clients in the Fintech space including accounting & tax apps.

Moov Financial announces a $45 million Series B round of funding. The round was led by Commerce Ventures with participation from Andreessen Horowitz.

Oxygen announced $20 million in Series B funding – led largely by return investors – and the appointment of David Rafalovsky as Chief Executive Officer.

LATAM

Medsi raised a USD $10 million debt-financing round from CAPEM Mexico.

XP Asset bought a minority stake in the financial services company One7. The deal was closed through an investment of R$ 110 million.

Brick Insurance received a Pre-Seed round of investment led by Verve Capital.

ASIA

Eazy Digital raised $850,000 in seed funding led by Wavemaker Partners, a Singapore and Los Angeles based seed investor.

Gobi Partners announced that it has onboarded two fintech firms to its Gobi Superseed II Fund (Gobi SSII Fund).

AUSTRALIA 🇦🇺

Hnry completed its AUD$35m Series B round as it unveils ambitious growth plans to double headcount, expand internationally and invest in further product innovation.

AFRICA

MNT-Halan raised up to $400 million in equity and debt financing from local and global investors as it continues to serve underbanked and unbanked customers in the North African country.

Lulalend finalized a transformational $35 million (R600 million) Series B funding round.