#DoneDeal FinTech Funding News | 2023 #37

Weekly Funding news up to Friday, 15th of September 2023

REPORT

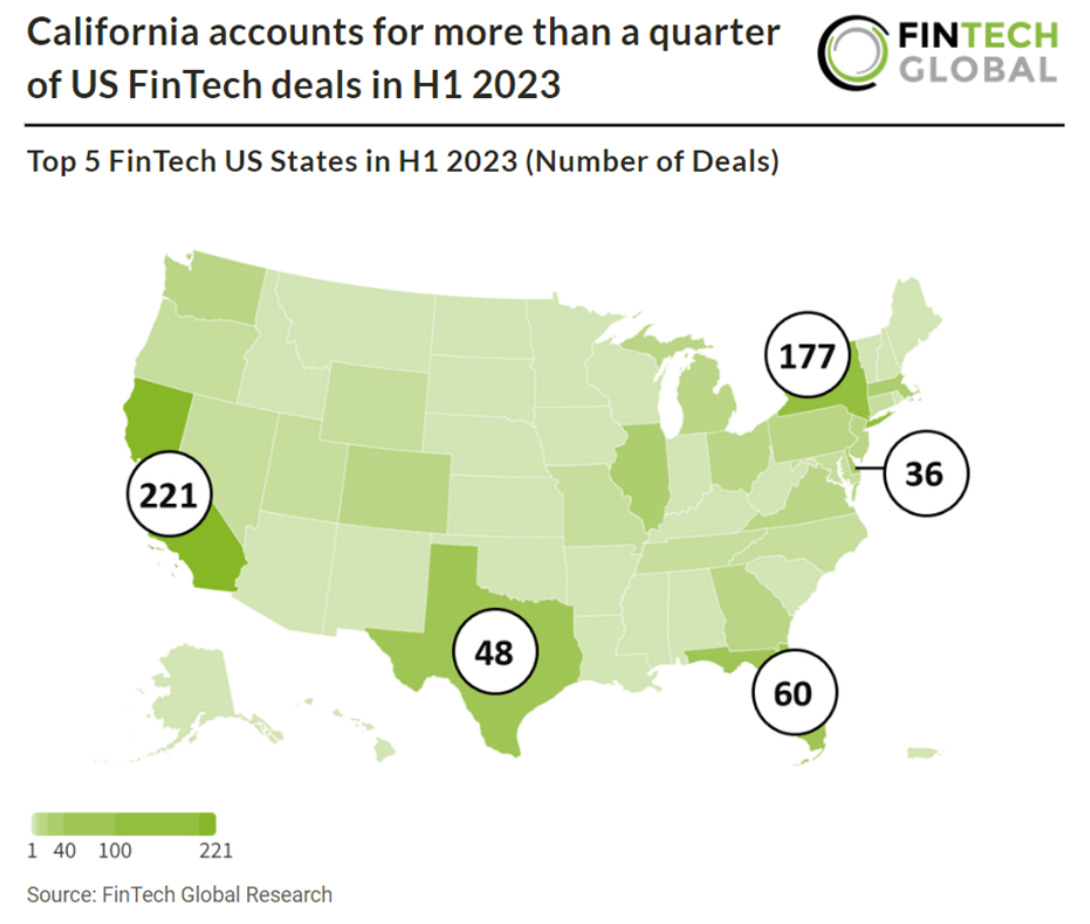

‣ California was the most active US state for FinTech investment with a 26.8% share of all deals in the country.

‣ US FinTech deal activity reached 821 transactions in H1 2023, a 53% drop YoY.

‣ US FinTech companies raised a combined $13.1bn in H1 2023, a 56% drop from H1 2022.

👀 NEWS HIGHLIGHT

The acquisition of BillMe will help Razorpay provide businesses with a hybrid model to engage better with end customers, the unicorn said in a statement. However, it didn’t disclose the financial details of the deal.

📰 ARTICLE

💰From Funding to Investing: The dual role of FinTech Giants in today's market

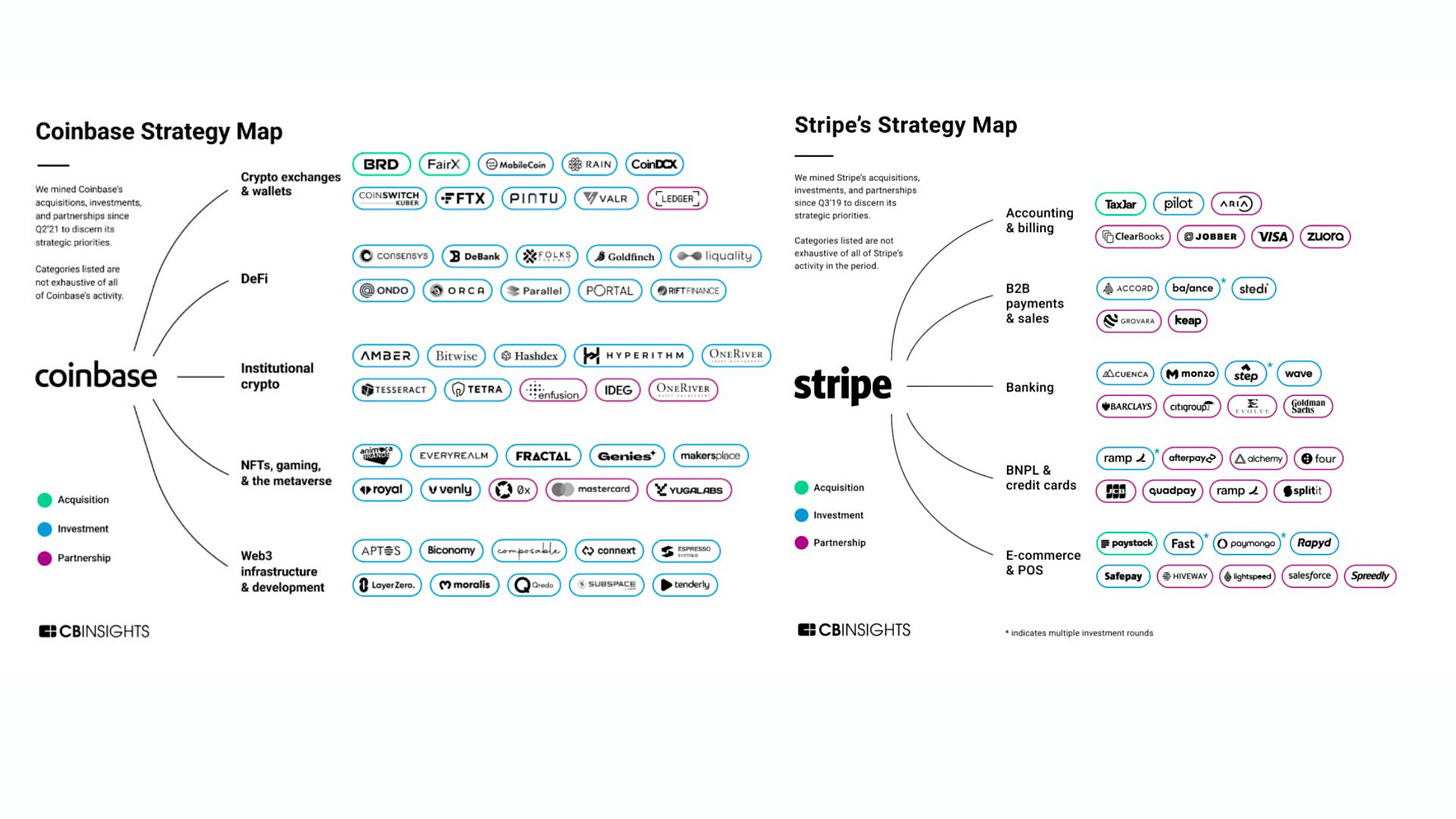

Drawing from a deep dive into the FinTech landscape, it's intriguing to observe that several startups, upon securing venture capital funding, swiftly channel those funds into investments in other emerging startups. This trend is emblematic of the dynamism that defined the zenith of market fervor.

💡INSIGHTS

‣ Funding dropped by 70% to pre 2020 levels driven by the end of mega round and flight to quality;

‣ A retreat in Payments and Challenger Banks as the traditional resilient sector loses its crown to Crypto and Lending given valuation benchmarks achieved in 2022;

‣ US, Asian and Strategic investors are retrenching and are in 50-100% less deals than they were last year

Download and read the complete report for more interesting info, stats and figures here

🤝 M&As

Rauva is to acquire the bank Banco Empresas Montepio for around €30m, advancing its business solutions. This acquisition will enable Rauva to introduce financial offerings tailored for small-to-medium-sized enterprises, freelancers, and entrepreneurs, including innovative credit solutions.

Recharge has announced its successful acquisition of Startselect, a European digital gift and gaming cards company. This significant move positions the company on course to generate 750 million EUR in annual sales in 2024.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🎉 NOTABLE FUNDING ROUNDS

⭐️ VC NordicNinja closes new €200m fund and opens an office in London.

⭐️ Perfios has secured $229 million in Series D funding from private equity investor Kedaara Capital.

⭐️ Visa invests in Form3 with a focus on reducing fraud and increasing operational efficiency in real-time payments.

⭐️ By Miles founder raises $1m for financial planning startup Swallow.

UK 🇬🇧

Tradeteq announces the completion of its $12.5 million A Plus funding round.

Immix has emerged from stealth with a $2.7m (£2.2m) seed round which will be used to support further developments to Immix’s core trading platform.

EUROPE 🇪🇺

yeekatee announces an additional CHF 550k funding milestone, backed by FiveT Fintech and existing investor Ronald Strässler, a successful entrepreneur from the fintech industry.

Cleafy has raised a €10m funding round to expand its footprint among digital banks.

Swan has announced a €37 million Series B investment round. The fresh capital signals the onset of Swan’s renewed international ambition.

Fipto has raised €15 million in seed funding that it will use to accelerate its platform that enables companies to manage their corporate treasury and make international payments in fiat and digital currencies using blockchain technology.

USA 🇺🇸

Ampla has secured a $258 million credit facility with Goldman Sachs and Atalaya Capital Management.

LATAM

Syscap secures USD $2.3M in funding to expand its platform for non-banking lenders in Mexico, streamlining private credit access and management.

ASIA

F88 said it has secured a new credit facility worth US$50 million from Lending Ark Asia.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.

-