#DoneDeal FinTech Funding News | 2023 #7

Weekly Funding news up to Friday, 17th of February 2023

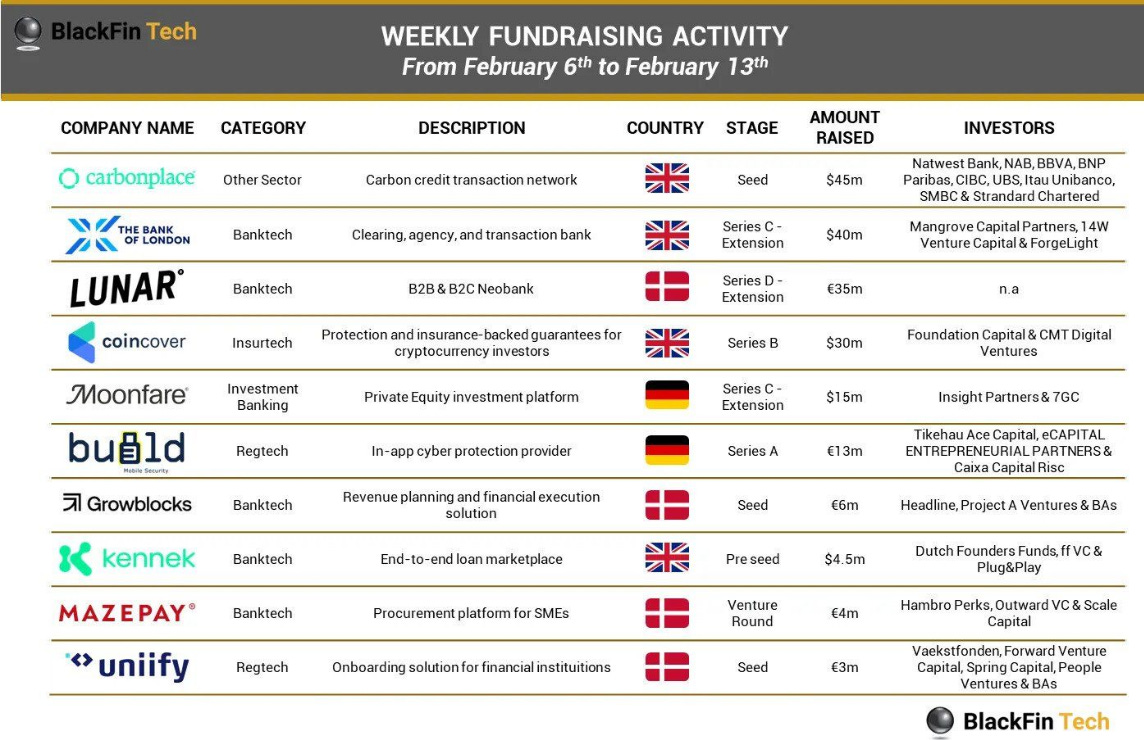

WEEKLY FUNDRAISING ACTIVITY

Last week, a total amount of €185.5m was raised across 10 European FinTech deals👇

REPORT

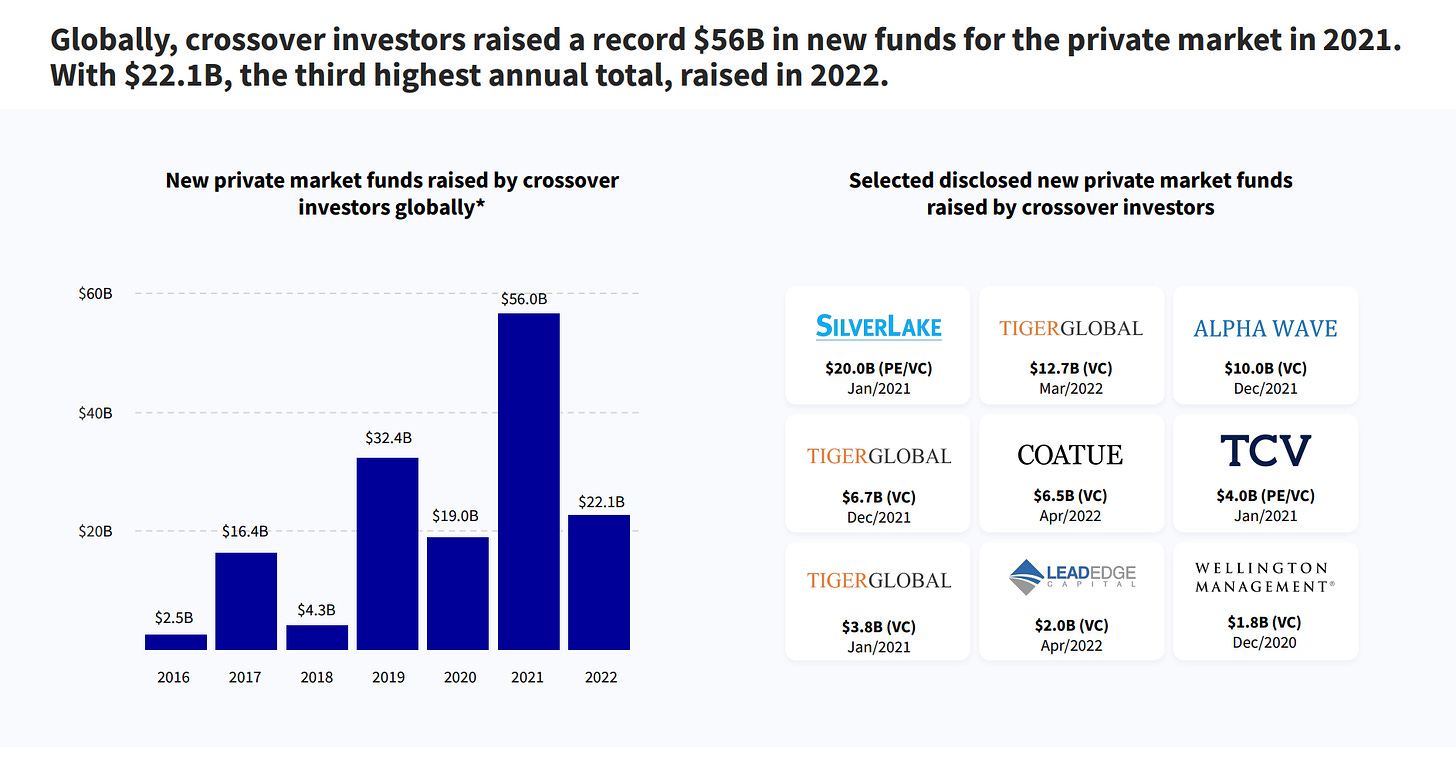

Crossover investors have bet heavily on FinTech and risen to key players in the tech ecosystem in the last few years.

Globally, Deep Tech and FinTech have been the top sectors for crossover investors in 2021 and 2022.

👀 NEWS HIGHLIGHT

Zopa snapped up buy now, pay later outfit DivideBuy, its first acquisition from a $75 million warchest raised earlier this year.

DivideBuy allows merchants to offer their customers interest free payment options at checkout. Under Zopa, DivideBuy will offer credit for larger purchases from £250 to £30,000.

😎 SPONSORED CONTENT

Fintech Meetup is Q1’s BIG new event! Find new leads and partners. Meet everyone you need to meet in 30,000+ double opt-in meetings. Hear from 250+ speakers. See 200+ sponsors & Exhibitors and network with 3,000+ other senior level fintechers. At the Aria, Las Vegas March 19-22. Get ticket!

📰 ARTICLE

Founded as a bookkeeping automation company, Toronto-based FinTech firm Paperstack pivoted into e-commerce lending last year when the economy was beginning to deteriorate.

Paperstack now secures $9 in equity.

💡INSIGHTS

The number of investments made in 2022 was nearly half of the number made in 2021, with Q4 2022 marking the slowest quarter in fintech funding since 2018. Despite the increased attention and maturation of FinTech private companies, there has been little conversation on exits.

Where did the market go wrong in valuing these assets?

🤝 M&As

FNZ agreed to acquire International Fund Services & Asset Management SA a Luxembourg-based B2B fund platform.

Royal Bank of Canada acquired OJO. Financial terms of the deal were not disclosed.

QUODD acquired Xignite, a leading global provider of financial market data APIs.

Digital currency exchange Coinmetro acquired Ignium for €4m.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🎉 NOTABLE FUNDING ROUNDS

⭐️ Aspire raised $100 million in a round that more than doubled its valuation, defying a market downturn for young tech firms.

⭐️ Hala acquired UAE-based online payment platform Paymennt.com.

⭐️ Cushon has been acquired by NatWest for £144m.

⭐️ Carbonplace raised $45m from its nine founder banks and formed its own entity.

FinTech Meetup in Vegas is just around the corner and I will start and close it with a bang. Join me and let's do this together!

UK 🇬🇧

Jupiter Asset Management has flogged its stake in Starling Bank and enacted a policy to stop its open-end funds from buying up shares in private companies.

Omnio completed a 9m Euros equity funding and keep the round open for selected investors, targeting a total of 12m Euros.

Landytech secured $12 million in Series B funding, led by Aquiline Technology Growth and additional investment from existing investor Adelie Capital.

Plus500 announced it would put £82m back in shareholders’ pockets after cashing in on “higher value” customers last year.

Sikoia raised $6m in seed funding for its onboarding and verification platform for financial institutions.

Atom Bank boss Mark Mullen offered a clear indication that the fintech is sticking with London for its highly anticipated IPO, likely to take place this year.

USA 🇺🇸

Nevly raised $1.25M in Pre-Seed funding, the round was led by Tenacity Venture Capital.

QUASH.ai just closed a $3.7 million seed round to expand its services to more financial institutions going forward across Latin America.

ModernFi raised $4.5 million in seed funding from Andreessen Horowitz and founders from JPMorgan Chase, AWS, Coinbase, Q2 and BlackRock.

Alongside closed an $11 million seed round led by Andreessen Horowitz.

CANADA

Levr.ai secures $1 million of pre-seed funding to change the way businesses access and manage loans, building a better experience for both business owners and financial lenders.

ASIA

MONIX secured US$20 million in the first close of its pre-IPO fundraising.

InsuranceDekho raised US$150 million in Series A funding round consisting of a mix of equity and debt.

Alibaba Group sold its remaining 3.4% stake in Paytm in a deal valued at $167m.

AdalFi raised $7.5 million in funding, funding round was led by COTU Ventures and Chimera Ventures, Fatima Gobi Ventures and Zayn Capital, and more.

GIMO raised US$5.1 million in the first close of its Series A funding round led by TNB Aura.

AUSTRALIA 🇦🇺

Shift raised $AUD27M in Series C funding, the round was led by Sequoia Capital Southeast Asia with participation from existing shareholders.

AFRICA

Power secures $3 million in seed funding to enter other African markets, DOB Equity led the round.

Curacel raised $3 million in seed funding to power insurance offerings and expand into North Africa.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.