👀 NEWS HIGHLIGHT

Capital on Tap secured its first-ever general-purpose corporate facility at £100m.

The large cash injection comes from Atalaya Capital Management and will be used to build a central hub designed to help small businesses in both the UK and the US to manage all aspects of business finance.

👉Read the full Altfi article here.

😎 SPONSORED CONTENT

Find out how Klarna Kosma’s Bank Transfer helped Kameo, Scandinavia’s leading real estate investment platform, build a faster, more convenient payment option that made it even easier for customers to invest and resulted in 18% crowd growth and a 30% bid size increase.

Click below to grab your copy now!

📰 ARTICLE

In 2021, a banner year for VC investment in FinTech, only 2% went to companies founded by women. 1% went to Black founders. 1.8% went to Latinx founders.

And, applying an intersectional lens, if you were raising in 2021 as a Black Woman or Latinx woman, your chances were basically zero.

👉 Read the full Workweek article here.

💡INSIGHTS

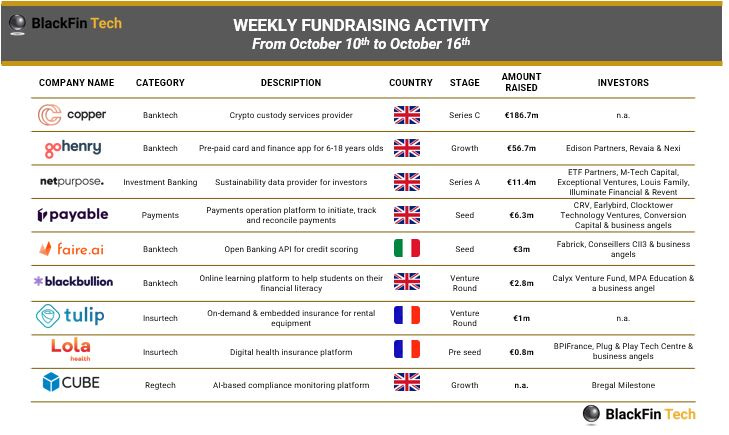

Last week, €269m was raised across 9 European FinTech deals.

👉 Read the full BlackFin Tech article by Régis Bouyoux here.

🧐 ANALYSIS

While Q3 has been quieter for cross-border payments in terms of M&As and funding rounds, there have still been some noteworthy developments.

👉 Read the full FXC Intelligence by Joe Baker here.

🤝 M&As

Q2 Holdings, Inc. announced its acquisition of Sensibill. Link here.

Westpac confirms it's in discussions to acquire 100% of Tyro. Link here.

BNP Paribas announced plans to acquire UK currency risk management company Kantox. Link here.

Aplazo bought data platform Sensai Metrics for an undisclosed amount to improve its merchant network and help brands manage marketing to customers. Link here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🎉 NOTABLE FUNDING ROUNDS

⭐️ Nexta launch 'next-gen banking' app with fresh $3M. Link here.

⭐️ Banyan raises $43M to grow its network of item-level purchase data. Link here.

⭐️ Uplinq Financial Technologies scores a $1.25m investment. Link here.

UK 🇬🇧

Koyo secured a £100m debt facility and nabbed a £5m extension of its Series A funding round. Link here.

Lukango raised £275,000 in a pre-seed funding round. Link here.

Ordo raises £10m Series A. Link here.

Paytrix announces that it has secured £5 million of new capital. Link here.

Plum raises £1m via crowdfunding. Link here.

EUROPE 🇪🇺

vestr secures $10m in funding round. Link here.

USA 🇺🇸

Credit Key nabs $115M in debt and equity. Link here.

Hello Divorce raised $3.25m in a seed funding round. Link here.

Bookkeep announced a $6.6 million seed+ round of funding. This round brings Bookkeep’s total funding to $10 million. Link here.

JPMorgan launches fundraising platform to lure startups. Link here. JP Morgan made a strategic investment in Tilia. Link here.

Exponential secured $14m from a funding round led by investor Paradigm. Link here.

Ualett secured a $50m credit line. Link here.

Mercantile launches with $22m in hand. Link here.

OatFi emerged from stealth with $8 million in new equity and $50 million in debt for its platform. Link here.

Astra secures $10 million in series A funding with a $30 million line of credit. Link here.

LATAM

Zulu secures a $5M seed round. Link here.

ASIA

Fundiin raises $5m in series A round. Link here.

bolttech announced that Tokio Marine, alongside other shareholders, will lead its Series B funding round. Link here.

Pillow attracts $18M funding. Link here.

AFRICA

Maplerad raises $6M, led by Peter Thiel’s Valar Ventures. Link here.

MOVERS & SHAKERS

1k(x) hired former Valour Inc. executive Diana Biggs as a partner. Link here.

Endowus acquired a majority stake in wealth manager Carret Private as the former continues its expansion plans in Hong Kong. Link here.

If you are a fintech startup and have over 100 questions send me an email, and maybe I can answer a few.