REPORT

FinTech has received special attention during this downturn as a category hit harder than most. While this is true, context is important.

Prior to the correction this year, the sector was trading at 40x – 60x forward gross profit multiples, a massive increase from even a few years ago.

👉 Read more interesting stats, figures, and views in the full article (and download the full report) by Coatue here.

REPORT

Africa has enjoyed an early-mover’s position in the application of fintech in effecting financial inclusion and economic transformation.

👉 Download the full Mastercard report here.

👀 NEWS HIGHLIGHT

Today I have an interesting Q&A to share with you. Meet Arjun Vir Singh. One of the leading LinkedIn voices for the Gulf Region, he’s an avid commentator of the FinTech scene and a Partner with Arthur D. Little (ADL) based in Dubai, UAE 👇

😎 SPONSORED CONTENT

Privacy Lock helps you protect your business and consumers with patent-pending privacy technology. Penta Privacy Lock helps you track what information you have collected on your customers, so you can comply with data management requirements.

💡INSIGHTS

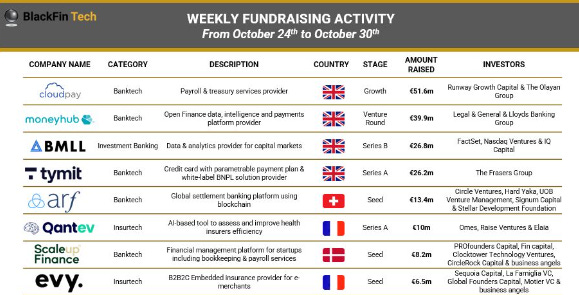

Last week, €195m was raised across 14 European FinTech deals.

👉 Read the full BlackFin Tech article by Régis Bouyoux here.

🧐 ANALYSIS

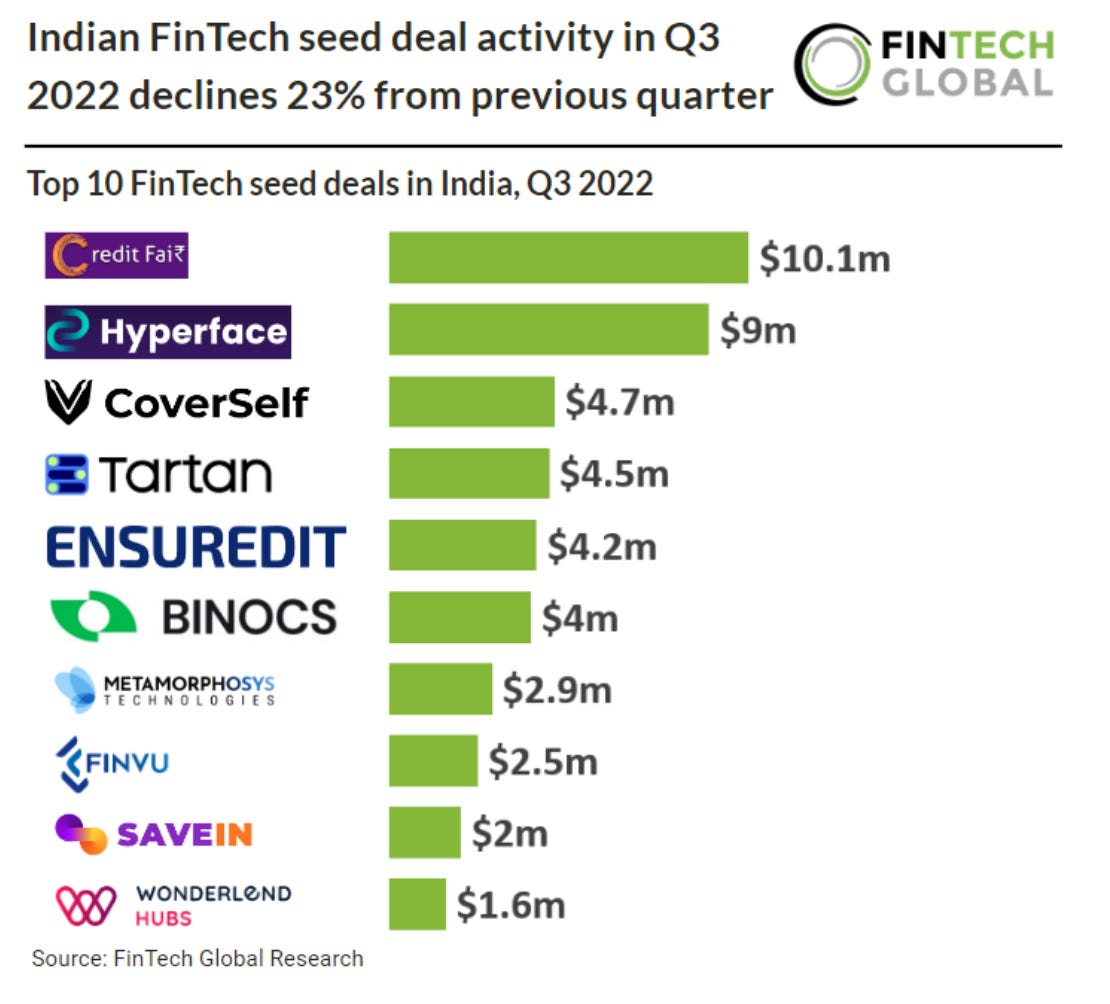

In total there were 21 Indian FinTech seed deals in Q3 2022, a 23% decrease from the previous quarter.

👉 Check Top 10 FinTech seed deals in India from Fintech Global here.

🦄 UNICORN CLUB

Wise bagged £300 million in capital in the form of a syndicated debt facility from Silicon Valley Bank. Link here.

💰 VC FUNDS

Nasdaq Ventures backs corporate treasury fintech's $7.3M Series A. Link here.

Nordic VC Inventure closes €150m fund and opens for angel investments. Link here.

Francisco Partners backs the growth of the restaurant tech platform TouchBistro. Link here.

🤝 M&As

Payhippo acquired Maritime Microfinance Bank (MFB), a financial institution specializing in saving products, demand deposits, and investments as well as micro and SME loans. Link here.

Ampla Technologies acquires Upside Financing; forms new product Ampla Pay Later. Link here.

Bakkt Holdings, Inc. signed a definitive agreement to acquire Apex Crypto, LLC from Apex Fintech Solutions, Inc. Link here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🎉 NOTABLE FUNDING ROUNDS

⭐️ Money Fellows raised $31 million in what it describes as the first close of its Series B investment. Link here.

⭐️ Global FinTech financing activity totaled $4.8 billion across 265 deals in October 2022 with ten $100 million+ funding rounds. Link here.

⭐️ Swiss FinTech companies raised $384m in Q3 2022 which pushes Swiss FinTech investment projections in 2022 to over $1.1bn. Link here.

UK 🇬🇧

Plend raised £40 million in seed funding. Link here.

EUROPE 🇪🇺

Funding for Portuguese fintech has exceeded the €1bn mark for the first time. Link here.

The European Investment Bank (EIB) is investing €15 million into Izicap. Link here.

USA 🇺🇸

Lama AI announces a $9 million seed investment to unlock credit opportunities for small-medium businesses. Link here.

iink Payments raises $3.0 MM in seed II to streamline P&C claims payments for the insurance restoration industry. Link here.

A16z’s flagship crypto fund dropped 40% in value. Link here.

Zest AI raised over $50 million in a new growth round. Link here.

Bitwise is expanding from passive to active management in an effort to attract more institutional investors. Link here.

LATAM

Mattilda raises USD $10M to help Latin American schools streamline financial processes. Link here.

Vixtra raised $3 million in a pre-Series A round led by Valor Capital. Link here.

ASIA

Tinkoff raised $16 million to launch a fintech start-up focused on Southeast Asia and initially targeting the Philippines. Link here.

Udaan raised $120 million and aims to go public in 12 to 18 months. Link here.

Decentro raises $4.7M in Series A funding round. Link here.

MIDDLE EAST

Trigo Vision Ltd. raised $100 million. Link here.

Bahrain attracts US$72.7 million worth of investment in financial services. Link here.

PayTabs launched super payments platform. Link here.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.