👀 NEWS HIGHLIGHT

UK-based payment fintech Banked has announced the closure of a $15 million in Series A to bring pay-by-bank to the world.

A extension round, which, with their oversubscribed original Series A round, brings their total investment to over $50 million to date.

👉 Read the full TFN article here.

😎 SPONSORED CONTENT

The Integrated solutions for startups and SMEs, with More than 45k Merchants,

achieving more then 1 million transaction per day worth of $11 million.

📰 ARTICLE

It's official. Investors have been shying away from direct-to-consumer fintechs in 2022, as we head into a recession.

B2C fintechs — of the likes of neobanks, investing apps and wealth managers — have brought in the least funding rounds this year since 2015.

👉 Read the full Sifted article here.

💡INSIGHTS

Global PayTech companies raised a combined total of $2bn in Q3 2022 with Klarna, a buy now pay later (BNPL) platform, accounting for 39% of the funding with their latest $800m venture round.

👉 Check the full FinTech Global article here.

🧐 ANALYSIS

US firms have generally been more active in the crypto and decentralised finance space than European funds, but the investor which made the most investments in 2021 and 2022 (so far), according to Dealroom, was London-based investment firm and hedge fund Kingsway Capital, with 23 deals.

Here are the 10 most active US and European funds backing crypto and DeFi startups.

👉 Read the full Sifted article here.

💡INSIGHTS

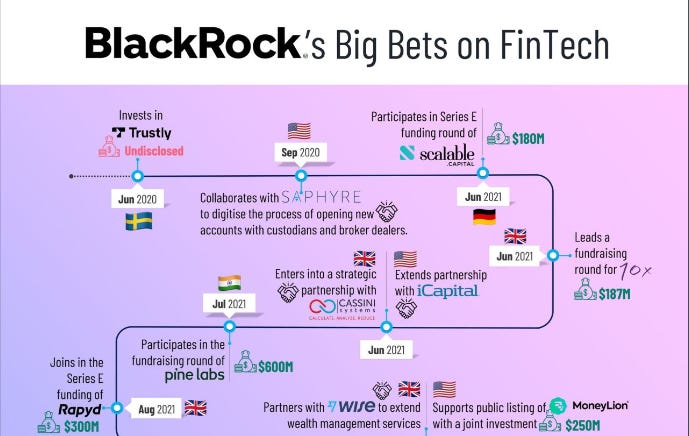

The Bedrock of Investments: BlackRock’s FinTech Foray 👇

Achieving the vision of helping more and more people experience financial well-being isn’t an easy feat, but one company is advancing on its conviction of building upon this purpose by extending its investment, advisory, and risk management biddings.

👉 Read the full WhiteSight article by Sanjeev Kumar and Samridhi Singh here.

💰 VC FUNDS

List of 42+ NYC-based funds who invest at the early stage. Link here.

Citi Ventures made its first fintech investment in India, joining a $60 million raise in bank lending software house Lentra. Link here.

🤝 M&As

Curve is in active discussions to acquire crypto lender BlockFi’s more than 87,000 credit card customers. Link here.

Opn, the one-stop payments solutions company from Japan and Southeast Asia has acquired MerchantE. Link here.

Climate First Bancorp acquires ESG data platform Ecountabl. Link here.

IBanFirst completes acquisition of Cornhill. Link here.

🛳 PARTNERSHIPS

Founders Forum Group and SVB expand partnership to support global innovation economy. Link here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🎉 NOTABLE FUNDING ROUNDS

⭐️ Paradigm marks down FTX investment to zero. Link here.

⭐️ FTX’s Bankman-Fried quietly invested more than $500 million in Sequoia and Other VCs. Link here.

⭐️ Wagepay announced that it has secured a $10 Million funding facility from FC Capital. Link here.

UK 🇬🇧

Boodil raised £525,000 in fresh funding as alternative payment methods continue to grow in popularity. Link here.

WeGift closed its Series B funding round on £26m. Link here.

EUROPE 🇪🇺

OjirehPrime raised $1,240,000 backed by Ex-Interswitch Board Chairman. Link here.

LATAM

Levannta raised USD $2m funding round. Link here.

Trully raises USD $4.1M. Link here.

ASIA

Vananam launches alternative investment platform 2.0 and plans to raise Rs 160 crores (USD 20 million) in new funding. Link here.

Binance’s Chief Executive Officer Changpeng ‘CZ’ Zhao announced plans for an industry recovery fund amidst FTX’s staggering collapse in recent weeks. Link here.

ADDX raised approximately US$20 million in an upsized Pre-Series B round. Link here.

Beam raises US$2.5 mil seed funding. Link here.

MIDDLE EAST

Baraka is looking to expand its presence in the GCC and Egypt as it raised $20 million in a recent funding round. Link here.

$9.8bn hedge fund LMR is opening an office in Dubai as it looks to expand in the UAE. Link here.

Pyypl raises US$20M series B investment to expand in MENA. Link here.

AFRICA

Funding to African fintech startups drops by 58% in Q3 2022 as early-stage deals hit 90%. Link here.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.