Last week €178,8m was raised across 11 European FinTech deals.

Congratulations to BeZero Carbon on raising a €51,6m Series B, congratulations to WeGift who raised a €29,6m Series B round and finally congratulations to Napo Pet Insurance on raising a €17,1m Series A.

👉 Read the full BlackFin Tech overview article by Régis Bouyoux here.

REPORT

N26 has seen more former employees go on to launch startups of their own than any other private European unicorn.

Other fintech unicorns — including Klarna, Revolut and Wise — have also seen dozens of employees begin businesses, in a strong sign that startup success spawns more startup success.

👉 Read the full Sifted article here and download the full Dealroom.co report here.

😎 SPONSORED CONTENT

2022 is set to be a pivotal year in the adoption and regulation of cryptocurrencies. So as regulators, policymakers and the media pay more attention to the financial crime risks associated with crypto, what can compliance teams do to ensure their AML programs are best-in-class? Our new guide addresses this question.

Download your free copy today 👇

📰 ARTICLE

As some people may be aware Assure, one of the larger SPV providers in the US, gave notice to its clients that they will be closing shop at the end of this year:

That is pretty big news - going by their numbers we are talking over 8,800 investments and 50,000 investors affected.

Assuming the Average SPV size ($1.49M as quoted in their State of SPV report), that is $13.2Bn of assets that are at risk of being liquidated.

👉 Read all about this news in Arik Oslerne’s article here.

💬 INTERVIEW

Great interview with Carolynn Levy, inventor of the SAFE;

“The one thing that irks me is when people call it a SAFE note,” Carolynn Levy laughs.

👉 Read the full interview article by Mercury / Meghna Rao here.

🧐 ANALYSIS

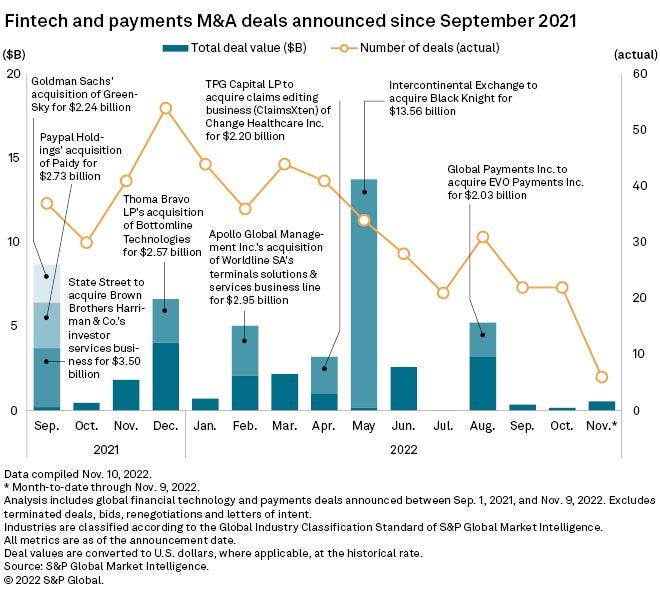

FinTech M&A Deal Tracker: Banks regain appetite for buying Fintechs.

Large financial technology deals have been thin on the ground in recent months but banks, which have been conspicuously absent, are firmly back in the picture.

👉 Read the full S&P Global source article here.

💡INSIGHTS

Odin co-founder Patrick Ryan created a database of about 6,000 European investors, categorised by sector and stage 👇

👉 Read the full list/database of investors here.

💰 VC FUNDS

OTB Ventures launched a €150mn deep tech fund to invest in European businesses. Link here.

🤝 M&As

Mastercard is acquiring a minority stake in Conferma Pay as part of a wider partnership to push the use of virtual cards for B2B travel payments. Link here.

Tide bought lending marketplace Funding Options. Link here.

Equals Group acquires open banking platform Roqqett. Link here.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🎉 NOTABLE FUNDING ROUNDS

⭐️ Greenwood raises $45M in funding. Link here.

⭐️ FWD Group announced the launch of an RM45 million fund in collaboration with Malaysian venture capital firm Artem Ventures. Link here.

⭐️ VentiPay raises USD $370K. Link here.

UK 🇬🇧

Treecard raised £19.2 million in Series A funding. Link here.

Bumper raised £26.1 million in funding from its Series A extension round. Link here.

EUROPE 🇪🇺

Kiln announces €17 million in funding to expand staking offering. Link here.

Keyrock raised $72 million in a Series B funding round. Link here.

JP Morgan made a strategic investment in Edge Laboratories and Evooq. Link here.

USA 🇺🇸

Totem raised $2.2 million in pre-seed funding. Link here.

CANADA

Buckzy raised US$14.5 million in a Series A funding round. Link here.

LATAM

Finkargo raised $75 million to help small businesses finance international trade ops. Link here.

ASIA

Igloo increases its Series B to $46M. Link here.

Fundaztic raises RM16 Million in less than two weeks on pitchIN. Link here.

AUSTRALIA 🇦🇺

FrankieOne raised A$23 million (around US$15.4 million) in a series A+ funding round. Link here.

Moneytech scores an additional $150m debt facility for Equipment Finance growth. Link here.

MIDDLE EAST

Shield raises $20M. Link here.

AFRICA

Ejara raised $8 million in Series A investment. Link here.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.