Mercury Raises $300M Series C Led by Sequoia Capital

Weekly Funding news up to Friday, 28th of March 2025.

WEEKLY FUNDRAISING ACTIVITY

👀 NEWS HIGHLIGHT

Mercury, the FinTech platform rethinking how startups and small businesses manage their money, has raised $300 million in a Series C funding round.

The raise includes both primary and secondary investments and values the company at $3.5 billion, more than double its $1.6 billion valuation in 2021. Sequoia Capital led the round, joined by new investors Spark Capital and Marathon, with continued support from Coatue, CRV, and Andreessen Horowitz.

💡INSIGHTS

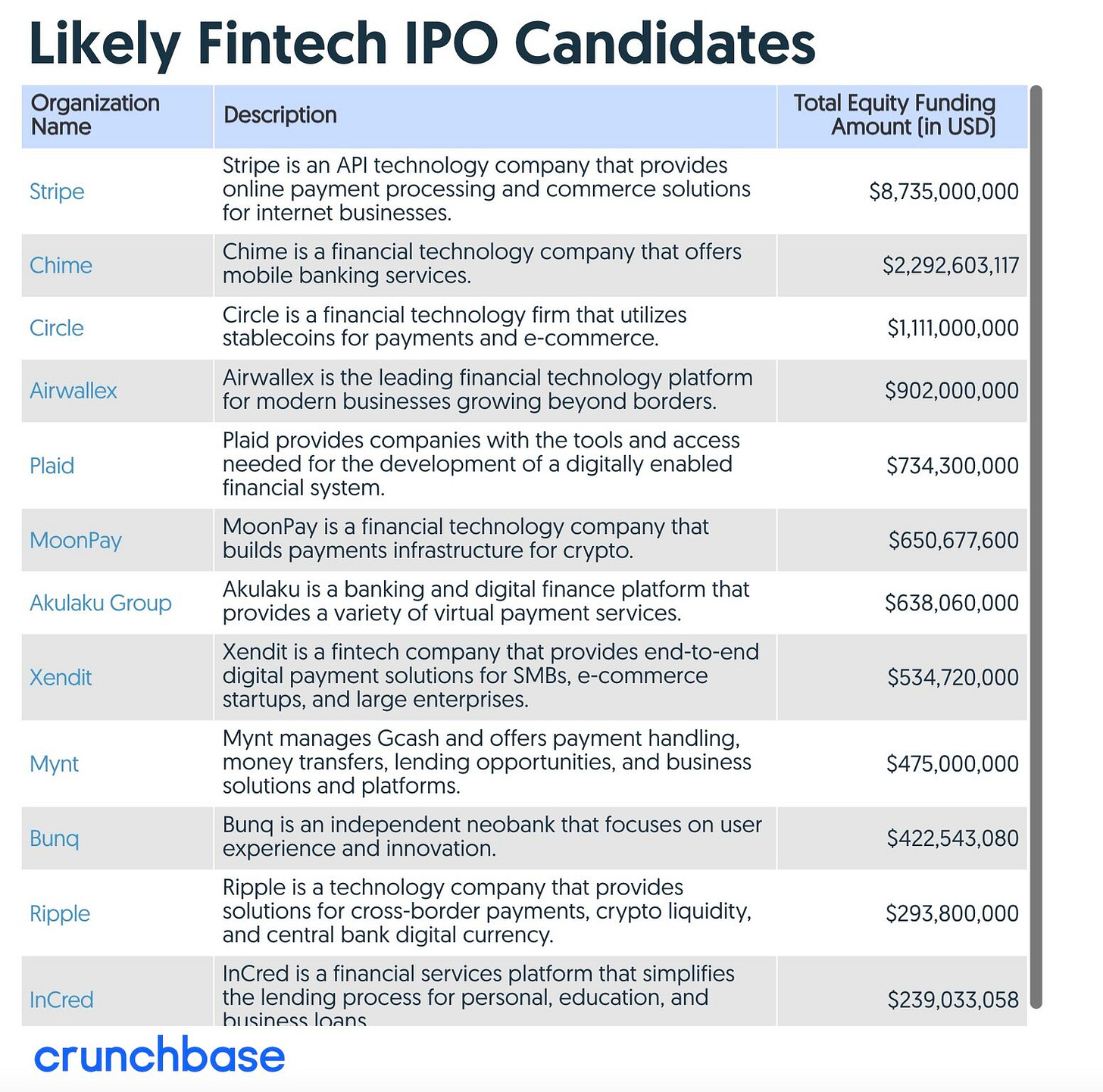

Here's Crunchbase’s list of Likely FinTech IPO Candidates 👇

Which company do you think will go public first?

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🎉 NOTABLE FUNDING ROUNDS

⭐️ Firenze raises £2.5M seed round led by Outward VC.

⭐️ Welsh FinTech Burbank raises £5M to bring in-store payments to e-commerce.

⭐️ Loyalty platform Squid closes €1.7 million crowdfunding round.

⭐️ Advent Nears $3 Billion-Plus Continuation Fund for Xplor.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

Multiply Mortgages raises $23.5 million. Michael White, CEO and co-founder, Multiply said, “Our mission is to help employees - whether frontline workers or corporate staff - access lower mortgage rates and expert guidance, at zero cost to their employer.”

EUROPE 🇪🇺

French FinTech RockFi secures €18M from Partech and others. The company plans to use the funds to support its growth and aims to achieve €1B in assets under management by the end of 2026. Keep reading

USA 🇺🇸

Lumber raises $15.5m to enhance workforce management platform with agentic AI. With the new funding, CEO Shreesha Ramdas revealed plans to expand early wage access, introduce workers’ compensation insurance, and more than triple the company’s headcount.

Crypto card issuer Rain raises $24.5 million in a round led by Norwest Venture Partners. The company will use the money raised in this round to expand its team, develop new technologies, and apply for additional regulatory licenses. Continue reading

Retail trading platform eToro filed for an initial public offering (IPO) in the United States on NASDAQ under the symbol “ETOR”. The proposed size and price range for the share sale will be disclosed in a later filing when EToro is ready to begin marketing the offering.

LATAM

Latin American neobank Ualá boosted its Series E round by $𝟲𝟲 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 in a second close bringing the total raised to $𝟯𝟲𝟲 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 USD. The funds raised through the equity sale will be used to continue growing across Latin America, with a special focus on Mexico.

ASIA

Solaris investor SBI completes ownership process. The acquisition of the majority stake was announced as part of Solaris’s EUR 140 million Series G funding round, secured in February which will help lay the foundations for sustainable growth and accelerate the company's path to profitability.

AFRICA

Ex-Network International execs raise $6.75M for Enza, an African FinTech serving banks. The new capital will go toward expanding the team and rolling out new products for its banking clientele across Africa. Continue reading

Nigerian FinTech Payhippo rebrands as Rivy, raises $4 million for clean energy financing. The funding, split evenly between $2 million in debt and $2 million in equity, will help the company expand beyond Nigeria with its clean energy financing solutions for businesses.