Stacks Raises $10 Million for AI-Powered Financial Close Solution

Weekly Funding news up to Friday, 21st of February 2025.

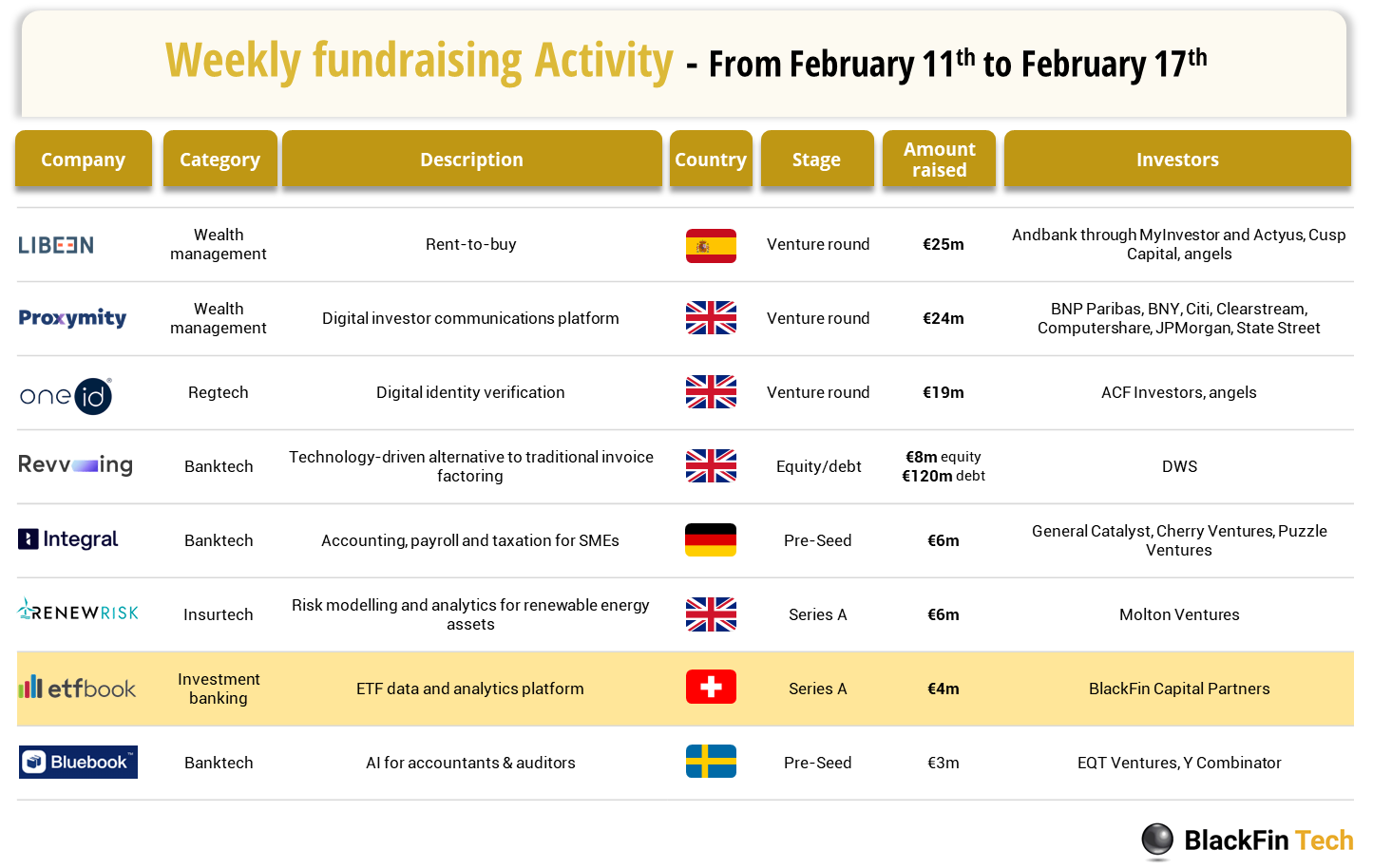

WEEKLY FUNDRAISING ACTIVITY

👀 NEWS HIGHLIGHT

An employment tribunal case has placed Kuda Technologies, one of Africa’s fastest-growing digital banks, under scrutiny over allegations of workplace discrimination, harassment, and wrongful dismissal. Rosemary Hewat, Kuda’s former group chief people officer (CPO), filed a complaint accusing the company and its CEO, Babatunde Ogundeyi, of sex discrimination, victimization, and unfair dismissal.

According to the filing, Hewat, who held the senior role for nearly three years, claims the company forced her out in April 2024 after prolonged mistreatment. She filed the case with the U.K. Employment Tribunal, and TechCrunch has reviewed the legal documents.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🎉 NOTABLE FUNDING ROUNDS

⭐️ Projected valuations for 2025 IPO candidates based on 2024 revenue.

⭐️ Stacks Raises $10 Million for AI-Powered Financial Close Solution.

⭐️ Nigeria suing Binance for $81.5 billion in economic losses and back tax.

⭐️ Shift4 to Acquire Global Blue, the Leading Specialty Payments and Technology Provider Serving Luxury Brands.

Stay Updated on the Go! Join my new Telegram channel for daily Digital Banking updates and real-time breaking news. Stay informed and explore the Future of Banking—subscribe now!

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

E-Money Markets secures £700K, bets big on future of SME FX. The investment will allow markets to fund its technology infrastructure to support wider adoption, expand its FX and payment product range to better serve brokers and SMEs, secure necessary regulatory licenses and onboard strategic partners within the FX brokerage industry.

Ziglu raises £5 million and plans to introduce Ziglu Coin. FCA-approved Ziglu lets Brits buy and sell eleven cryptocurrencies, earn yield via its ‘Boost’ products, pay using a debit card, and move and spend money. Users will be able to earn Ziglu Coin unlocking rewards and benefits via an upcoming enhanced subscription programme.

EUROPE 🇪🇺

Dutch Payments company CM.com announced that it has raised €20M. The company will use the proceeds to strengthen its balance sheet and provide greater operational and tactical flexibility during the next phase of the Company’s growth plan. Read more

USA 🇺🇸

Stablecoin firm Plasma secures $20m series A. The financing is aimed at supporting the development of Plasma’s blockchain network. Plasma is developing a blockchain specifically designed for Tether’s USD-pegged stablecoin, USDT. Continue reading

Digital Bank Varo Bank aims to raise $55 Million. The funding round is part of a Series G offering of preferred shares, not voting common stock and warrants to acquire more common shares. Varo offers savings and credit services. It also includes cards, ATM access, early pay, and other features while touting its “no hidden fees” promise.

ASIA

Gaorong Ventures invests $30 million in crypto unicorn. The firm invested in HashKey Group at a pre-money valuation above $1 billion. The valuation remains little changed from a year ago, when Hashkey raised $100 million and reached unicorn status, according to sources.

Saudi FinTech lite secures $3.2m in pre-seed funding. The round was led by Scene Holding, with participation from prominent angel investors, marking a significant milestone in lite’s journey to redefine the payments ecosystem for businesses in Saudi Arabia.

AFRICA

TransUnion and FICO partner to introduce groundbreaking risk solutions in Kenya to expand credit access. This collaboration aims to improve credit-granting processes by equipping lenders with these advanced tools to manage portfolio risk and monitor credit activity.

Flutterwave expands its foreign exchange solution “Swap” to its Send App. By integrating Swap into Send App, Flutterwave provides a secure and instant way for users to exchange Naira (NGN) for US Dollars (USD), British Pounds (GBP), and Euros (EUR), with more currencies to come.

MOVERS AND SHAKERS

Goldman, Point72 alumni hired at Blockchain.com amid IPO plans. The firm hired Justin Evans as Chief Financial Officer and Mike Wilcox as Chief Operating Officer, aiming to grow headcount by 50%. The hires align with the company’s long-term goal to go public, as Wall Street shows increasing interest in crypto IPOs.